-

NZD/USD scales higher for the third successive day amid the prevalent USD selling bias.

-

Bets that the Fed will not hike rates again and a positive risk tone undermine the USD.

-

Spot prices remain on track to snap a three-week losing streak ahead of the NFP report.

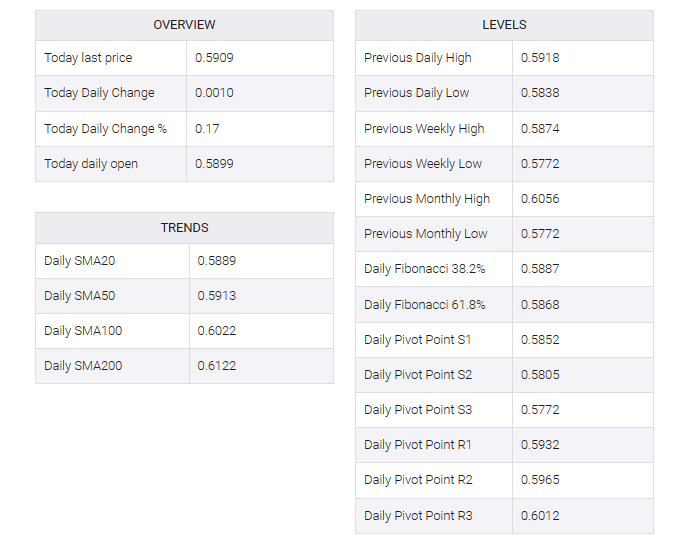

The NZD/USD pair attracted some buying for the third day in a row on Friday and rose above the 0.5900 mark in the first half of the European session. The spot price currently trades just a few pips below the two-week high touched on Thursday and now look to US monthly employment data for fresh stimulus.

The popularly known NFP report is due out later in the first North American session and should provide new indications about the Federal Reserve’s (Fed) next policy move. This, in turn, will play a key role in influencing near-term US dollar (USD) price dynamics and provide some meaningful impetus to the NZD/USD pair.

Moving to key data risks, expectations that the Fed is nearing the end of its policy tightening campaign continue to drag US Treasury bond yields lower. This, along with upbeat market mood – as illustrated by a positive tone around equity markets – weakens the USD and acts as a tailwind for the NZD/USD pair.

Meanwhile, a private-sector survey showed business activity in China’s services sector expanded at a slightly faster pace in October, another factor benefiting antipodean currencies including the New Zealand dollar (NZD). But that did little to ease market concerns about a slowdown in the world’s second-largest economy.

Also, growing acceptance that the Reserve Bank of New Zealand (RBNZ) will keep its policy rate unchanged in November, bolstered by weak domestic employment figures earlier this week, could limit the NZD/USD pair. This, in turn, warrants caution before placing new bullish bets and positioning for any subsequent appreciative action.

Hence, strong follow-through buying is needed to confirm that the NZD/USD pair has formed a near-term bottom. Nevertheless, spot prices remain on track to register strong weekly gains and snap a three-week losing streak to the lowest level since November 2022, around the 0.5775-0.5770 region touched last Thursday.