-

NZD/USD snaps its two-day losing streak ahead of US inflation data.

-

Market expects an increase in both monthly and yearly US CPI figures.

-

New Zealand Building Permits declined by 10.6%, marking a 15-month low.

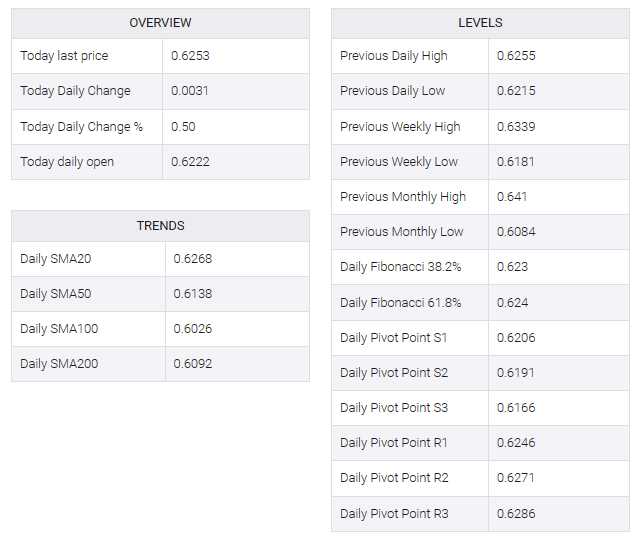

NZD/USD moved near 0.6250 during the European session on Thursday. The NZD/USD pair found upside support as market sentiment improved ahead of inflation data from the United States (US).

Later in the North American session, December consumer price index (CPI) data for the US will be released. Forecasts suggest both monthly and annual CPI increases, with expectations for a 0.2% increase in the monthly figure and a 3.2% increase in the annual figure. At the same time, core inflation is expected to ease to 3.8% on a year-over-year basis, while the month-over-month change is projected to hold steady at 0.3%.

Furthermore, market participants are pricing in five rate cuts by the US Federal Reserve (Fed) in 2024, which puts pressure on the greenback. The US Dollar Index (DXY) remained flat, weighed down by softer US Treasury yields.

New Zealand’s primary housing market index showed a decline in permit issuance for new construction projects in the country. In November 2023, seasonally adjusted building permits (MoM) saw a significant decline, falling 10.6%, marking a 15-month low compared to the previous reading, which showed an increase of 8.5%.

However, the positive Consumer Confidence and Business Confidence data in November have improved the market sentiment that the Reserve Bank of New Zealand (RBNZ) will uphold a hawkish stance by abstaining from any rate cuts in the upcoming meeting. This has been contributing to a favorable outlook for the New Zealand Dollar.