-

NZD/USD loses traction around 0.6242 amid the firmer USD.

-

China’s Caixin Services PMI rose to 52.9 in December vs. 51.5 prior, better than expected.

-

The US ADP Employment Change and weekly Initial Jobless Claims will be monitored by traders.

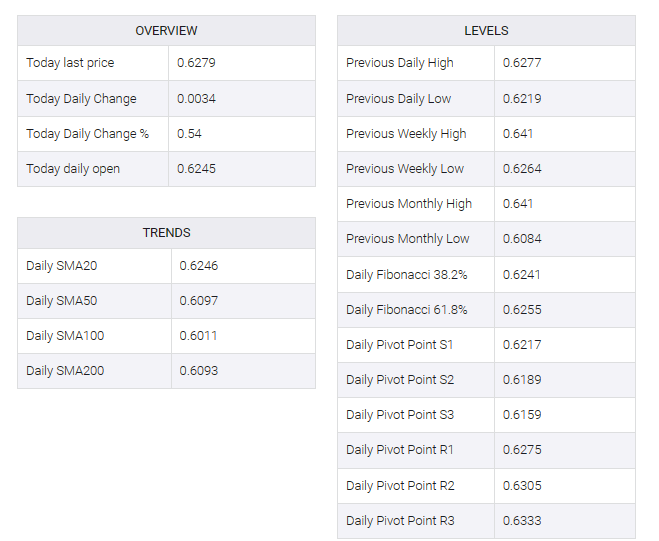

The NZD/USD pair extends its downside below the mid-0.6200s during the early Asian trading hours on Thursday. The downtick of the pair is bolstered by the stronger US Dollar (USD). In the absence of economic data released from the New Zealand docket, the NZD/USD pair remains at the mercy of USD price dynamics. The pair currently trades near 0.6242, losing 0.04% on the day.

New Zealand’s economy docket is quiet this week. Early on Thursday, China’s Caixin Services Purchasing Managers’ Index (PMI) jumped to 52.9 in December from a November reading of 51.5, above market expectations of 51.6.

Despite participants’ expectations for policy rates to be at or near the top during this tight cycle, the FOMC minutes made it clear that the direction of monetary policy will depend on how the economy performs. That being said, less bullish comments lifted the greenback and acted as a headwind for the NZD/USD pair.

US ADP employment changes and weekly initial jobless claims will be released later on Thursday. Focus will shift to highly anticipated US nonfarm payrolls on Friday. In addition, the unemployment rate and average hourly earnings will be published. Traders will take cues from these figures and find trading opportunities around the NZD/USD pair.