-

NZD/USD tumbles more than 0.70%, trading at 0.6124, erasing gains from Thursday’s session.

-

US jobs data was better than expected, spurring a dip in the unemployment rate.

-

University of Michigan Consumer Sentiment Index rises to 69.0, its highest level since August, with revised lower inflation expectations.

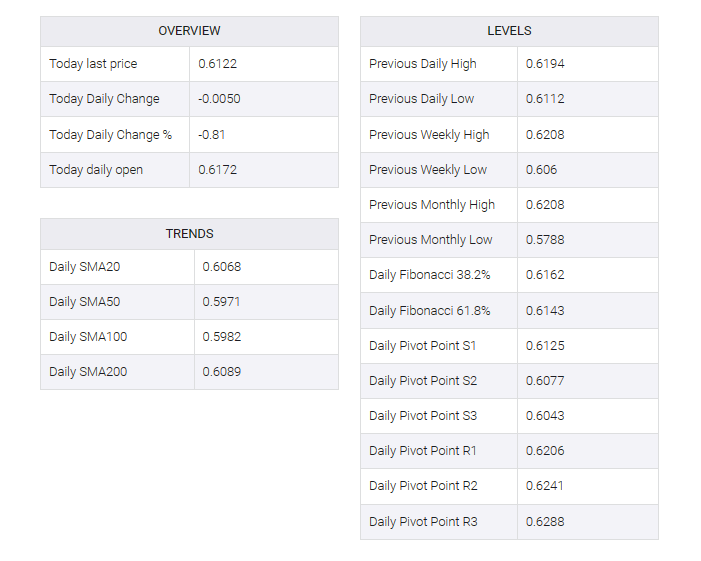

NZD/USD is dropping and erased Thursday’s gains on Friday after US economic data sent traders scrambling to pare dovish bets on the US Federal Reserve as November’s Nonfarm Payrolls exceeded estimates. That shows the economy’s resilience; hence, the pair tumbles more than 0.70% and trades at 0.6124.

NZD/USD finished the week down, traders eye next week’s FOMC meeting

As mentioned earlier, the US Department of Labor released the November nonfarm payrolls report, which left the labor market in better shape than data released earlier in the week. The economy added 199,000 jobs, up from 150,000 in October, and beating forecasts of 180,000. As a result, the unemployment rate fell from 3.9% to 3.7%, and average hourly earnings over the past 12 months to date have stood at 4%, out of the wage-price spiral negotiations.

Following the data release, NZD/USD saw a wide range and sank to the day’s low at 0.6103 before recovering some ground. Still, the loss came, with the pair set to end the week with a loss.

In addition, the University of Michigan (UoM) released its latest consumer survey, which showed that American households are more optimistic about the economic outlook, as the consumer sentiment index rose to 69.0, the highest level since August, while inflation expectations were revised lower.

The US Dollar Index (DXY), which tracks the buck’s performance against six rivals, rose 0.30% to 104.01, underpinned by a jump in US yields. The US 10-year bond yield rose 8 basis points to end the week at 4.236%.

In New Zealand, meanwhile, next week’s economic docket will include third-quarter gross domestic product (GDP) figures as well as the current account. Estimates came in at 0.2%, down from 0.9% growth in the previous quarter. On the US front, traders focused on next week’s US inflation report and the Federal Open Market Committee (FOMC) meeting.