-

NZD/USD extends its gains on bullish sentiment despite a stable US Dollar.

-

Kiwi Consumer Confidence improved to 93.1 from 91.9 prior.

-

Chicago Fed President Austan Goolsbee mentioned that the market’s enthusiasm for interest rate trajectory exceeded realistic expectations.

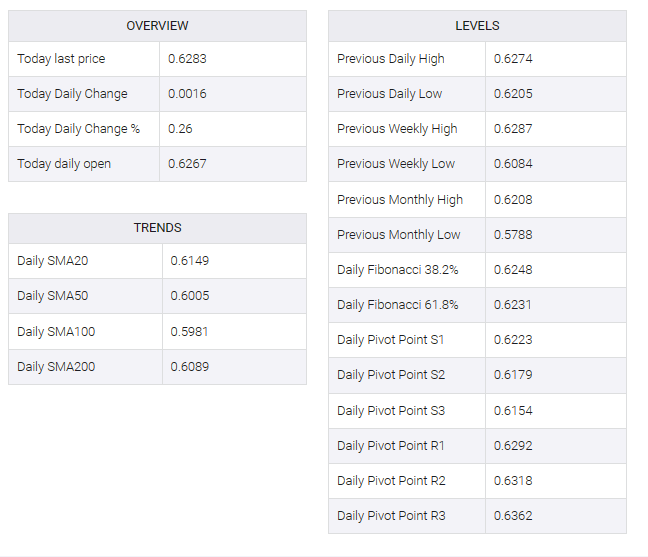

NZD/USD continued its winning streak that began on December 11, rising higher near 0.6280 in Wednesday’s early European session. Improved Kiwi consumer confidence data bolstered New Zealand dollar (NZD) strength against the US dollar (USD). ANZ – November Roy Morgan Consumer Confidence rose to 93.1 from the previous figure of 91.9.

Additionally, Reserve Bank of New Zealand (RBNZ) Governor Adrian Orr expressed surprise at the unexpected cut in New Zealand’s GDP data. However, he refrained from offering a definitive opinion on its implications for the interest rate outlook. Orr noted that there is still a significant journey ahead, especially considering persistently high inflation levels.

The US dollar index (DXY) traded higher near 102.20 despite lower US Treasury yields. The 2-year and 10-year yields on US bond coupons are lower at 4.38% and 3.89%, respectively. DXY faces downward pressure on a dovish sentiment around the US Federal Reserve (Fed), which points to the possibility of a rate cut in early 2024.

In a Wednesday morning interview with Fox TV, Austan Goolsbee, President of the Federal Reserve Bank of Chicago, cautioned that the market’s enthusiasm for potential interest rate cuts has exceeded realistic expectations. Goolsbee also noted that if inflation continues to decrease, the Fed may reevaluate the extent of its restrictions.

US Housing Starts outperformed expectations, reaching 1.56 million and surpassing the market consensus set at 1.36 million. However, Building Permits experienced a slight dip, registering at 1.46 million, just below the projected 1.47 million. Investors are anticipated to closely observe the changes in Existing Home Sales and the results of the CB Consumer Confidence survey scheduled for Wednesday.