-

NZD/USD continues its winning streak on a risk-on-market mood.

-

Atlanta Fed President Raphael Bostic expects 50 bps rate cuts by the end of 2024.

-

Chinese Zhongzhi’s bankruptcy liquidation might have weighed on the New Zealand Dollar.

-

Traders await the Kiwi Building Permits on Thursday to gain fresh cues on New Zealand’s economic landscape.

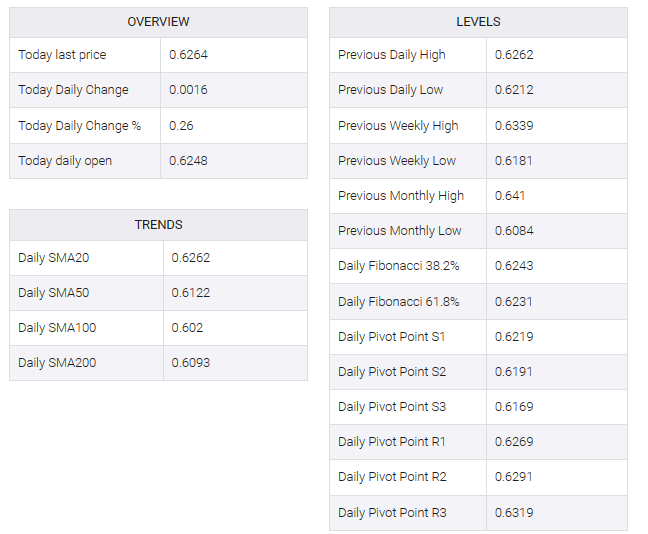

NZD/USD moves on an upward trajectory, extending gains for the third successive session. The NZD/USD pair trades higher near 0.6260 during the Asian hours on Tuesday. The pair rebounded from a three-week low at 0.6181 on Friday after mixed economic data from the United States (US).

Additionally, the NZD/USD pair appeared to be influenced by comments from Federal Reserve (Fed) members, suggesting a possible rate cut by the end of 2024. These comments created a risk-off sentiment and put downward pressure on the US Dollar (USD). ), consequently leading to an upward movement in the pair.

Atlanta Fed President Raphael W. Bostick’s expectation of a two-quarter-point cut by the end of 2024 reflects a cautious outlook, given earlier-than-expected inflation declines. On the other hand, US Fed Governor Michelle W. Bowman’s comments signaled a cautious stance, noting that the current policy stance appears quite restrictive, but acknowledging the possibility of the Fed cutting policy rates if inflation moves closer to the 2% target.

The US Dollar Index (DXY) appears to be extending its losses, trading near 102.10. As of press time, yields on 2-year and 10-year U.S. Treasury bonds stood lower at 4.37% and 4.02%, respectively.

China’s news of the bankruptcy of Zhongzhi Enterprise Group, a major player in the country’s shadow banking sector, could put a damper on the New Zealand dollar’s (NZD) advance. With significant liabilities of $64 billion, Zhongzhi Enterprise Group’s financial struggles raise concerns about contagion from a broader property debt crisis in the financial sector.

The focus on New Zealand building permits, particularly ahead of Thursday’s US Consumer Price Index (CPI) data, highlighted the potential impact on the NZD/USD pair. Additionally, Friday’s Chinese Consumer Price Index (CPI) and Producer Price Index (PPI) figures will likely attract attention given the interconnected global economic landscape.