-

NZD/USD intensifies on Chinese inflation and trade data.

-

Chinese CPI year-over-year fell by 0.3%. Meanwhile, the monthly figure eased to 0.1%.

-

Chinese Trade Balance USD increased to $75.34B in December and the yearly Imports CNY rose by 1.6%.

-

US CPI YoY and MoM rose by 3.4% and 0.3%, respectively, in December.

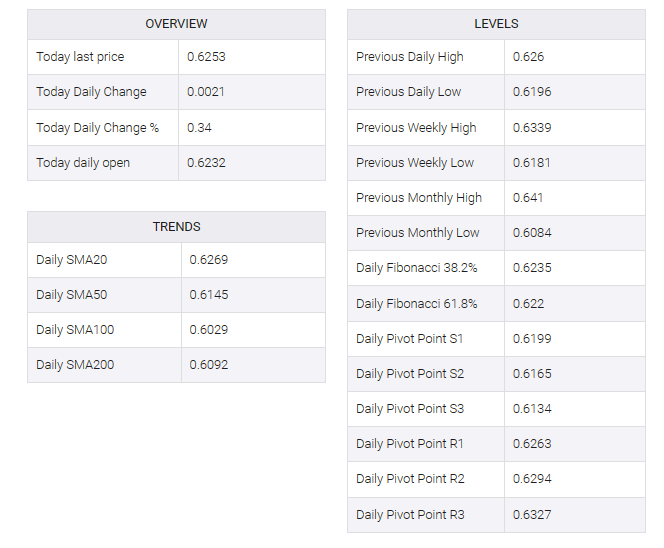

NZD/USD moved higher on an uptrend for a second straight session on Friday, improving near 0.6250 during the Asian session. The NZD/USD pair found support on the upside as risk appetite improved as traders bet on expectations of Federal Reserve (Fed) rate cuts in March and May despite upbeat inflation data from the United States (US). Additionally, moderate Chinese inflation data appears to bolster the strength of the New Zealand dollar (NZD) given the close trade relationship between the two countries.

In December, the Chinese Consumer Price Index (YoY) fell 0.3%, diverging from the expected 0.4% decline. The monthly consumer price index showed a more modest easing at 0.1%, compared to market expectations of 0.2%. Meanwhile, the annual producer price index fell 2.7%, slightly beating the expected decline of 2.6%.

Additionally, the Chinese trade balance for December increased to $75.34B from USD $68.39B previously, beating expectations of $74.75B. Exports (YoY) figure showed growth of 2.3% against 1.7% as expected. Meanwhile, annual imports CNY increased to 1.6% from 0.6% previously. Traders are looking forward to the release of US Producer Price Index (PPI) data for December, seeking additional insight into the economic landscape in the United States (US).

The US dollar index (DXY) pared recent gains in early Asian hours on Friday following positive US inflation data. However, despite improved US Treasury yields, DXY traded slightly lower near 102.20. The 2-year and 10-year yields on US bond coupons were trading at 4.26% and 3.97%, respectively, as of press time.

Furthermore, the upbeat US inflation data helped the US Dollar to achieve some upward traction. US Consumer Price Index (CPI) rose by 3.4% YoY in December, exceeding both November’s 3.1% and the anticipated market figure of 3.2%. The monthly CPI growth for December showed a 0.3% increase, exceeding the market projection of 0.2%. The annual Core CPI eased to 3.9% from the previous reading of 4.0%, while the monthly figure remained consistent at 0.3%, in line with expectations.