-

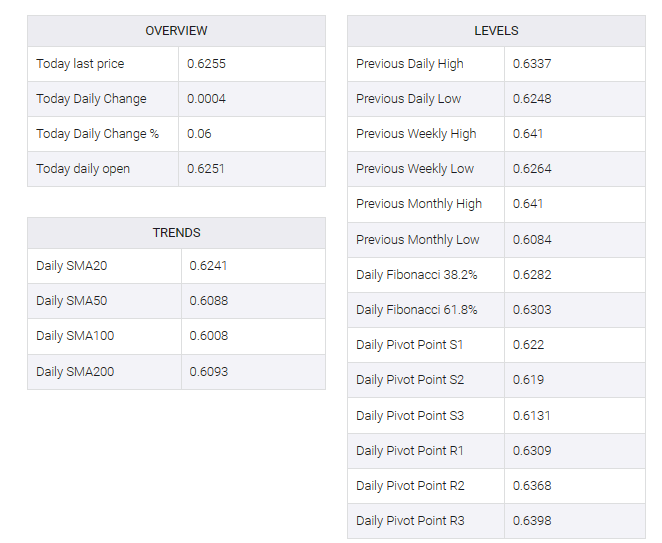

NZD/USD attracts some buyers around 0.6256, adding 0.08% on the day.

-

The FOMC signaled around three 25 basis points (bps) rate cuts in 2024.

-

China’s Caixin Manufacturing PMI rose to 50.8 in December versus 50.7 prior, better than estimated.

-

Market players will focus on Chinese Caixin Service and US ISM Manufacturing PMI ahead of FOMC Minutes.

The NZD/USD pair gained ground during early Asian trading hours on Wednesday. Renewed demand for the US dollar (USD) put some selling pressure on the pair. NZD/USD is currently trading near 0.6256, up 0.08% on the day.

At the FOMC December meeting, the committee indicated about three 25 basis point (bps) rate cuts in 2024. Markets expected no hike for the January meeting and a more than 78% chance of a rate cut by March 2024, according to the CME FedWatch tool.

The release of minutes of the December FOMC meeting late Wednesday will provide additional information on policymakers’ views. Traders will take further cues from US labor data. The NFP figure is expected to show the US economy added 168K jobs in December versus 199K in November, while the unemployment rate is projected to rise 3.8%. A stronger-than-expected daughter could challenge market expectations of a rate cut and push the USD higher against its rivals.

New Zealand’s economy docket is quiet this week. On Tuesday, China’s Caixin Manufacturing Purchasing Managers’ Index (PMI) rose to 50.8 in December from an expansion of 50.7 in November, better than market expectations of a 50.4 print. Positive developments around the Chinese economy could support the China-proxy New Zealand dollar (NZD) and act as a tailwind for the NZD/USD pair.

Looking ahead, market participants await the Chinese Caixin Services PMI for December. Also, the final US ISM Manufacturing PMI report and FOMC Minutes will be due on Wednesday.