-

NZD/USD scales higher for the second straight day and is supported by a combination of factors.

-

Expectations for additional stimulus from China boosts antipodean currencies, including the Kiwi.

-

The Fed rate uncertainty keeps the USD bulls on the defensive and acts as a tailwind for the pair.

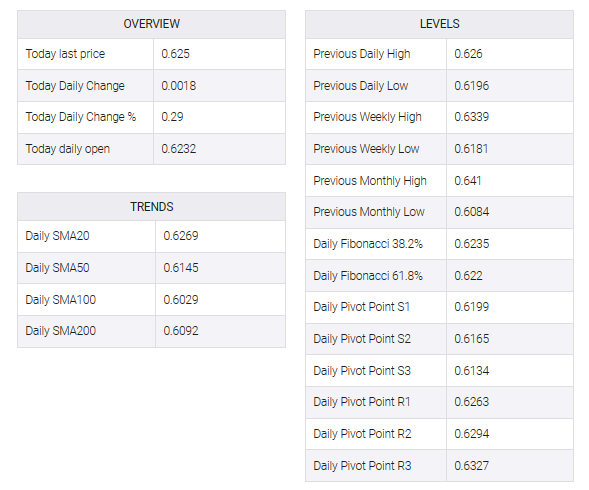

The NZD/USD pair builds on the overnight bounce from the sub-0.6200 levels, or the weekly low, and gains positive traction for the second successive day on Friday. Spot prices stick to modest intraday gains through the first half of the European session and currently trade around the mid-0.6200s, closer to the top end of the weekly range.

The National Bureau of Statistics reported that consumer prices in China remained in inflationary territory for the third consecutive month in December. Moreover, the producer price index (PPI), which measures the cost of goods at the factory gate, fell for the 15th consecutive month. This, in turn, fueled speculation about additional government stimulus and provided a modest lift to antipodean currencies, including the New Zealand dollar (NZD).

Meanwhile, the US dollar (USD) has been confined to a familiar range for the past week or so amid uncertainty over the Federal Reserve’s (Fed) interest rate path. This appears to be another factor lending support for the NZD/USD pair. That said, easing the odds for more aggressive policy acts as a tailwind for US Treasury bond yields, limiting geopolitical risks as well as losses in the safe-haven greenback.

In addition, continued concerns about deteriorating economic conditions in China could prevent traders from placing new bullish bets around the NZD/USD pair and should cap any meaningful appreciation moves. Fears resurfaced after data showed China’s imports rose less than expected in December, pointing to still weak domestic demand. This offset optimistic export figures, which indicated that world trade was beginning to recover.

The aforementioned mixed fundamental backdrop, coupled with the recent range-bound price action of the NZD/USD pair witnessed over the past week, makes it prudent to wait for a strong follow-through buy before placing fresh bullish bets. Traders are now looking ahead to the release of the US Producer Price Index (PPI). That, along with a scheduled speech by Minneapolis Fed President Neel Kashkari, could provide some inspiration during the North American session.