-

NZD/USD loses ground near 0.6100 ahead of the key US event.

-

The new coalition government of New Zealand passed legislation to abandon the RBNZ dual mandate and focus solely on price stability.

-

The Federal Reserve (Fed) is widely expected to hold interest rates steady at 5.25%–5.50% at its last meeting of the year.

-

Investors will closely monitor the Federal Reserve’s (Fed) monetary policy meeting ahead of New Zealand’s GDP growth for Q3.

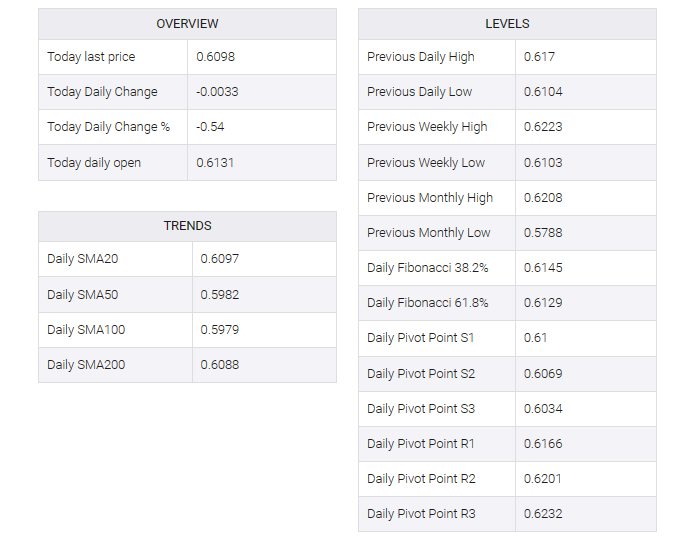

The NZD/USD pair faced some selling pressure in the early European session on Wednesday. The pair touched an intraday low of 0.6093 after coming back from a high of 0.6139. The pair is currently trading near 0.6097, down 0.54% on the day.

Early on Wednesday, New Zealand’s new coalition government passed legislation to abandon the Reserve Bank of New Zealand’s (RBNZ) dual mandate and focus solely on price stability. In addition, Finance Minister Nicola Willis revised the remit for the RBNZ’s Monetary Policy Committee (MPC), moving away from the objective of supporting maximum sustainable employment to an inflation target of 1-3%.

Also, New Zealand’s annual current account deficit widened to 7.6% of GDP in the third quarter (Q3) ended September, up from the previous reading of 7.5%. Investors are looking forward to third quarter gross domestic product (GDP). If the report comes in worse than expected, it could weigh on the New Zealand dollar and act as a headwind for the NZD/USD pair.

On the USD front, the Federal Reserve (Fed) is expected to keep interest rates steady at its year-end meeting on Wednesday. Markets expect Fed Chair Jerome Powell to maintain a hawkish tone and push back against rate cut bets. Last week, Fed Chair Powell said it would be premature to say we’ve reached a restrictive stance, adding that the central bank is ready to tighten policy if necessary.

US inflation, as measured by the Consumer Price Index (CPI) rose 0.1% MoM and 3.1% YoY in November, matching market estimates, the US Bureau of Labor Statistics showed on Tuesday. Meanwhile, core CPI, which excludes volatile food and energy prices, rose 0.3% MoM and 4.0% YoY, as expected.

Traders will be closely watching the US Producer Price Index (PPI) on Wednesday ahead of the Federal Reserve’s (Fed) monetary policy meeting. On Wednesday, New Zealand’s GDP growth numbers for Q3 will be released. The quarterly growth rate is estimated to expand by 0.2% and the annual rate is forecast to increase by 0.5%. Market players will take cues from this data and find trading opportunities around the NZD/USD pair.