-

NZD/USD weakens as RBNZ’s inflation report suggests an economic slowdown.

-

Kiwi’s Business Services Index fell from the previous reading of 50.7 to 48.9.

-

Downbeat Chinese inflation could impact the Kiwi Dollar.

-

US-China Presidential meeting is scheduled for Wednesday during the Asia-Pacific Economic Cooperation summit in San Francisco.

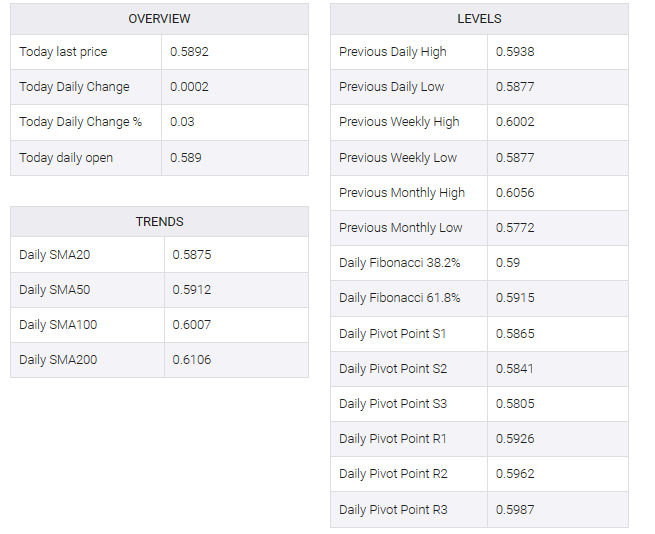

NZD/USD is caught in a losing streak, extending for the sixth straight session. The pessimistic global economic outlook casts a shadow over the NZD/USD pair. Spot prices traded lower around 0.5890 during Asian hours on Monday.

The Reserve Bank of New Zealand’s (RBNZ) inflation report helped weaken the NZD/USD pair as New Zealand is a significant commodity exporter. The report suggests a prevailing sentiment pointing to an expected decline in prices, possibly linked to an economic slowdown and a decline in demand for goods and services. The expectation seems to be setting the stage for a change in the economic landscape.

Kiwi business paints a picture of the NZ PSI services index for October, which fell to 48.9 from the previous reading of 50.7. The data could increase pressure on the Kiwi dollar (NZD), suggesting it faces additional challenges.

A record annual decline in China’s inflation in October could dampen the outlook for global growth. This directly affects the New Zealand dollar (NZD), given its role as a major commodity exporter to China.

Market participants are awaiting the upcoming US-China presidential meeting. Scheduled for Wednesday during the Asia-Pacific Economic Cooperation summit in San Francisco, it is the first in-person meeting between President Biden and President Xi in over a year. The agenda is wide-ranging, covering global issues from the Israel-Hamas conflict to Russia’s invasion of Ukraine, fentanyl production and discussions around artificial intelligence.

The US Dollar Index (DXY) bid near 105.80 edged sideways despite improving US Treasury yields. The 10-year U.S. bond coupon yield stood at 4.66%, up 0.17% by press time.

Federal Reserve (Fed) Chair Jerome Powell’s recent hawkish comments did little to lift the greenback’s spirits. Powell expressed concern that current policies may not be strong enough to bring inflation down to the coveted 2.0% target.

The US Dollar (USD) faced a challenge on Friday following the release of preliminary US Michigan consumer sentiment data. The report indicated a decline in consumer sentiment, which fell to 60.4 in November from 63.8 the previous month.

Traders are expected to focus on the US Consumer Price Index (CPI) to be released on Tuesday. Kiwi’s side is the producer price index – output to be released later in the week. Meanwhile, China’s industrial production and retail sales will be under watch on Wednesday.