-

NZD/USD surges on improved economic data from New Zealand.

-

Westpac Consumer Survey and Business NZ PSI improved to 88.9 and 51.2, respectively.

-

The dovish comments from Fed officials contributed to pressure to undermine the US Dollar.

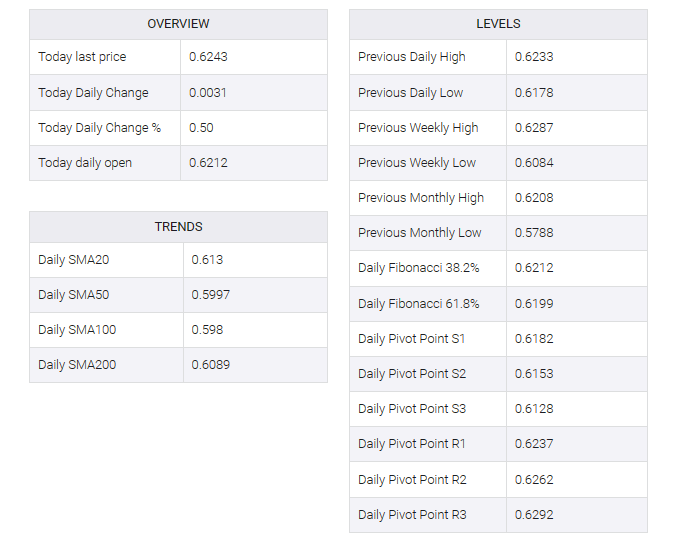

NZD/USD continues to advance on an upward trajectory that began on December 11, trading higher near 0.6240 during the European session on Monday. The New Zealand Dollar (NZD) gained ground against the US Dollar (USD) on the back of improved Kiwi economic data.

Westpac New Zealand released a consumer survey for Q4, showing an improvement from the previous reading of 80.2 to 88.9. The November business NZ Performance of Services Index (PSI) rose to 51.2 from the previous figure of 49.2. On Friday, the Business NZ Performance of Manufacturing Index (PMI) improved to 46.7 from 42.5 previously.

On the other hand, Atlanta Fed President Raphael Bostic suggested the possibility of a rate cut in the third quarter of 2024 if expected inflation eases. Meanwhile, Chicago Fed President Austin Golsby did not rule out a rate cut at the Federal Reserve meeting next March.

These dovish comments from Federal Reserve officials contributed to a rise in US Treasury bond prices, which, in turn, pushed down US yields. Lower US yields put pressure on the US Dollar Index (DXY). As of press time the DXY moved below 102.50.

Market participants seek further impetus on economic conditions in both countries. New Zealand will release Trade Data, the NZ Business Confidence survey, and ANZ – Roy Morgan Consumer Confidence. The United States will release Housing data on Tuesday.