-

NZD/USD struggles to halt the losing streak amid improved US Dollar.

-

MACD suggests tepid momentum, monitoring for potential shifts in market dynamics.

-

The pair could revisit the 1.0750 major level aligned to the weekly high at 1.0756.

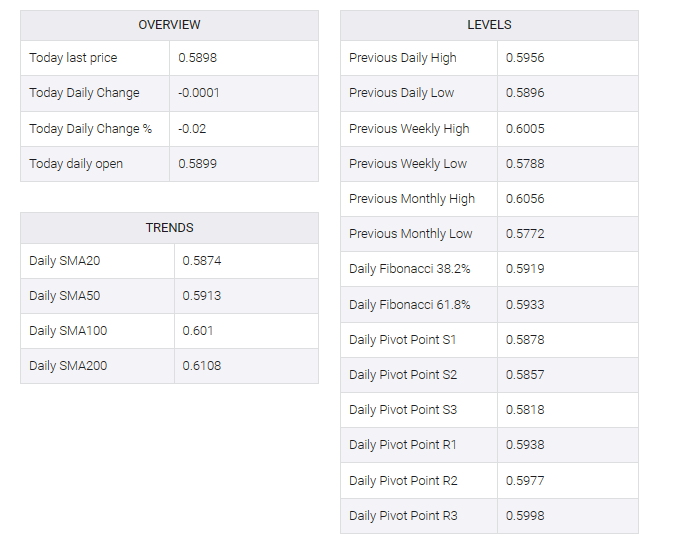

NZD/USD continued its losing streak for a fifth straight day, trading near the 14-day exponential moving average (EMA) at 0.5898 during European trading hours on Friday, aligned with immediate resistance at 0.5900. Fed Chair Jerome Powell’s endorsement of further interest rate hikes has put downward pressure on the Kiwi pair.

The 23.6% Fibonacci retracement level at 0.5923 is identified as an important resistance point for the NZD/USD pair to advance further. If the pair manages to firmly break above this level, it could provide support for bullish momentum, allowing traders to explore the territory near the previous week’s high at the psychological level of 0.6000.

The 14-day Relative Strength Index (RSI) is below the 50 level, indicating bearish pressure. This suggests a bearish momentum and reflects a weak market sentiment for the NZD/USD pair. As a result, the pair could be pushed towards key support at the 0.5800 psychological level, with the next possible support level at the previous week’s low of 0.5789.

However, the Moving Average Convergence Divergence (MACD) line is below the centerline but above the signal line in the NZD/USD pair. This configuration suggests a subdued momentum, reflecting the state of uncertainty in the market. Traders can monitor this situation closely for possible changes in market dynamics.