-

NZD/USD takes offers to refresh intraday high while reversing below 50-DMA.

-

Steady RSI, 200-DMA can challenge short-term Kiwi bears.

-

Buyers need validation from previous support line from early March.

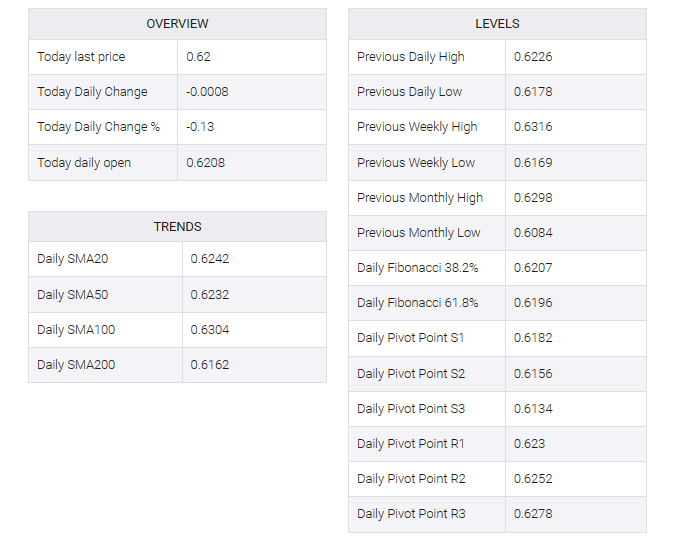

NZD/USD renewed the intraday low at 0.6190 early on Wednesday, reversing the previous day’s recovery. In doing so, the Kiwi pair took a U-turn from just below the 50-DMA barrier, as well as blunting the first-week bounce off the 200-DMA close.

It is worth noting that the stationary RSI (14) line joins the Kiwi pair’s inability to cross the DMA band to suggest further sideways performance in NZD/USD price between the 50-DMA and 200-DMA around 0.6230 and 0.6160 respectively.

Given the quote’s latest U-turn from the 50-DMA, the quote is likely to drop towards the 200-DMA support at 0.6160.

However, the quote’s weakness before 0.6160 could leave NZD/USD vulnerable to testing the annual lows identified in March near 0.6080.

After that, the 50% and 61.8% Fibonacci retracement levels of the Kiwi pair from October 2022 to February 2023, around 0.6025 and 0.5900 respectively, could tempt the bears.

On the flip side, recovery moves not only need to stay beyond the 50-DMA hurdle of 0.6230 but should also mark a successful break of the previous support line stretched from early March, close to 0.6315, to convince the NZD/USD bulls.

Should that happen, the Kiwi pair buyers could easily refresh the monthly high, currently around 0.6385.

NZD/USD: Daily chart

Trend: Limited downside expected