-

NZD/USD climbs back closer to the weekly high, though struggles to capitalize on the move.

-

The risk-off mood seems to cap the risk-sensitive Kiwi near the 0.6250-0.6260 confluence.

-

A break back below the 0.6100 mark will shift the near-term bias back in favour of bears.

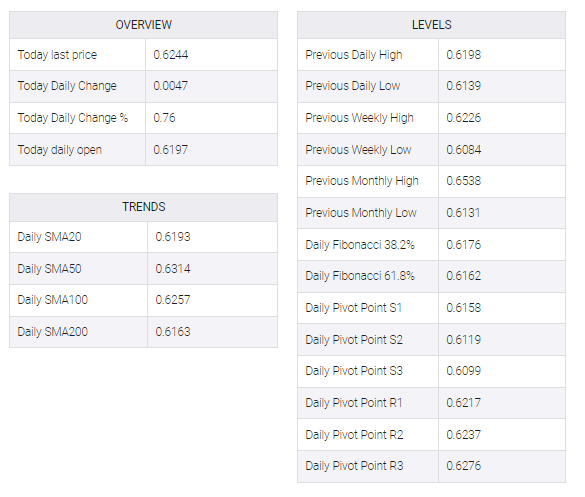

The NZD/USD pair is based on the previous day’s Goodish Rebound from the area 0.6140-0.6135 and gets strong follow-up traction for the second day drawn on Friday. The pair maintains its bid tone through the starting session of North America, though it seems to be struggling to capitalize on this step and is below 0.6260-0.6270, with interruption or weekly height.

The obstacles mentioned include 200-day exponential movements (EMA) and 38.2% of the February-March falls at the Fibonachi retraction level. Out of which the Oscillers have just begun to achieve positive traction in the daily chart, a sustainable step will be seen as a new trigger for the bullish traders and the recent recovery of the NZD/USD pair will create the stage to extend the YTD from lower touch last week.

The next move-up can then allow the spot price to recover 0.6300 round-fig mark, which matches 50% FIBO. The level speed may extend further and the NZD/USD pair can be up to 61.8% FIBO. The layer, around the 0.6360 region, is on the next relevant obstacle in front of the 0.6400 round-figure mark.

A new wave of risk-turning trade globally, however, holds the bull from the aggressive bet around the risk-sensitive Kiwi and caps the NZD/USD pair. Nevertheless, technical setup supports some meaningful opposite possibilities. So, 0.6200 round-fig mark, or 23.6% of the fibo that toward any of the poolback. The level can still be seen as a purchase opportunity and is more likely to be at least limited.

It says that a credible break under the latter can deny the positive view and return the nearest-seeing bias to the beerish traders. The NZD/USD pair may accelerate the fall towards intermediate support of 0.6135-0.6125 before going down to the 0.6100 mark. The spot price weakens the spot price to challenge 0.6000 psychological symbols, selling some follow-thru or YTD lower under 0.6085 area.