-

NZD/USD trades higher on the expectation that the Fed has ended its rate-hike cycle.

-

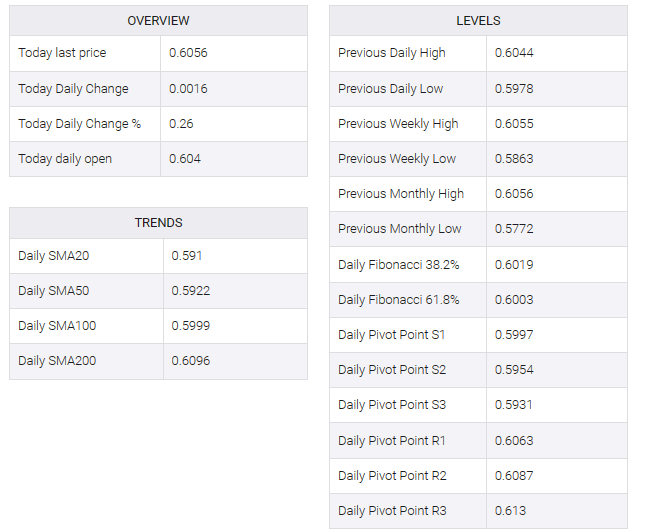

Technical indicators suggest a bullish sentiment to explore the psychological resistance around 0.6100.

-

23.6% Fibonacci retracement at 0.6004 could act as the support aligned with the nine-day EMA.

NZD/USD extended gains near three-month highs, trading near 0.6050 in the early European session on Tuesday. Selling pressure on the US dollar (USD) continues, as there is a growing consensus that the Federal Reserve (Fed) has ended its policy-tightening campaign. Market sentiment is now leaning towards the possibility of the Fed cutting rates beginning in March 2024.

The 14-day Relative Strength Index (RSI) is above the 50 level, indicating a bullish sentiment for the NZD/USD pair. This could encourage bullish moves towards the psychological resistance level near 0.6100.

Furthermore, the moving average convergence divergence (MACD) line, located above the center line and diverging above the signal line, indicates a bullish momentum in the market.

On the downside, the 23.6% Fibonacci retracement at 0.6004 could serve as an important support level, followed by the nine-day exponential moving average (EMA) at 0.5988. A decisive break below the EMA could potentially pave the way for testing the 38.2% Fibonacci retracement at 0.5960, aligned with the significant level at 0.5950.