-

NZD/USD falls sharply to near 0.6330 as US Treasury yields attempted recovery.

-

The USD Index has printed a fresh five-month low near 100.60.

-

NZD/USD aims for stabilization after a Falling channel breakout.

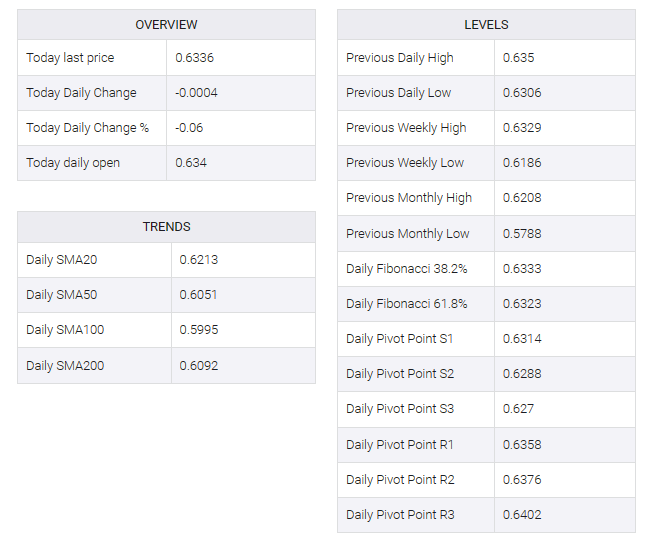

The NZD/USD pair has fallen to near 0.6330 amid a surprise recovery in the US Treasury yields. The 10-year US Treasury yields have rebounded to near 3.82%. The broader appeal for the Kiwi asset remains upbeat as investors lean towards expectations of early rate cuts by the Federal Reserve (Fed).

S&P500 futures added some gains in the London session, reflecting an improvement in market participants’ risk-appetite. The U.S. dollar index refreshed near a five-month low of 100.60 as easing price pressures on the U.S. economy may allow the Fed to discuss unwinding interest rates earlier than previously expected.

The New Zealand dollar will take effect following the release of Caixin manufacturing PMI data for December, which will be released on Tuesday. Economic data is expected to remain above the 50.0 threshold. Being a proxy for the Chinese economy, the New Zealand dollar will benefit from upbeat factory data.

NZD/USD holds higher after breakout of falling channel chart pattern formed on daily scale. The upwardly sloping 20-period exponential moving average (EMA) at 0.6230 continues to provide support to New Zealand dollar bulls.

The Relative Strength Index (RSI) (14) oscillates in a bullish range of 60.00-80.00, indicating that the upside remains intact.

Gradual correction towards the round-level support of 0.6300 would emerge as a buying opportunity for the market participants, which will drive asset towards intraday high at 0.6370, followed by December 26 high near 0.6410.

On the flip side, a downside move below December 25 low at 0.6246 would expose the asset to November 29 high at 0.6208 and December 14 low at 0.6168.