-

NZD/USD gains ground despite downbeat trade data from New Zealand.

-

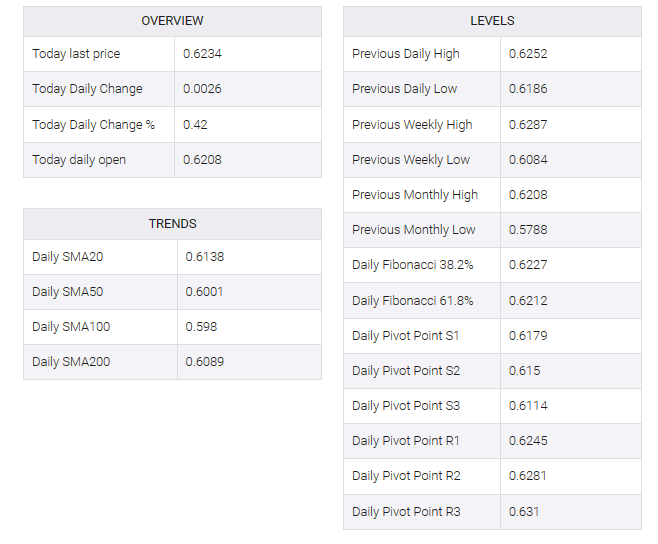

Technical indicators suggest bullish sentiment to revisit a five-month high at 0.6251.

-

The psychological level at 0.6200 could act as key support followed by the nine-day EMA at 0.6186.

NZD/USD continued its winning streak that began on December 11 despite disappointing trade figures from New Zealand. NZD/USD rose around 0.6230 during European time on Tuesday.

Trade balance NZD (MoM) data for November, as reported by Statistics New Zealand, revealed a trade deficit of $1,234 million, slightly higher than the expected deficit of $1,200 million. On a year-over-year basis, the deficit stood at $13.87 billion, lower than the expected deficit of $14.82 billion.

The 14-day Relative Strength Index (RSI) is above the 50 level, signaling a bullish sentiment. This suggests that the NZD/USD pair could potentially retest the key 0.6250 level, in line with the five-month high of 0.6251. If the pair can break this resistance area, it may find support in exploring the psychological zone around 0.6300.

Additionally, positive moving average convergence divergence (MACD) lines above both the centerline and signal line can act as confirmation of bullish momentum in the market.

On the downside, a break below the psychological support level of 0.6200 could push the NZD/USD pair to fall to the area near the nine-day Exponential Moving Average (EMA) at 0.6186 level followed by the 23.6% Fibonacci retracement at 0.6165 before the major support at 0.6150.