-

NZD/USD could face challenges on risk-off market sentiment.

-

A break above 0.6300 could support the pair to approach the weekly high at 0.6329.

-

The lagging indicator MACD could give confirmation of the downward trend.

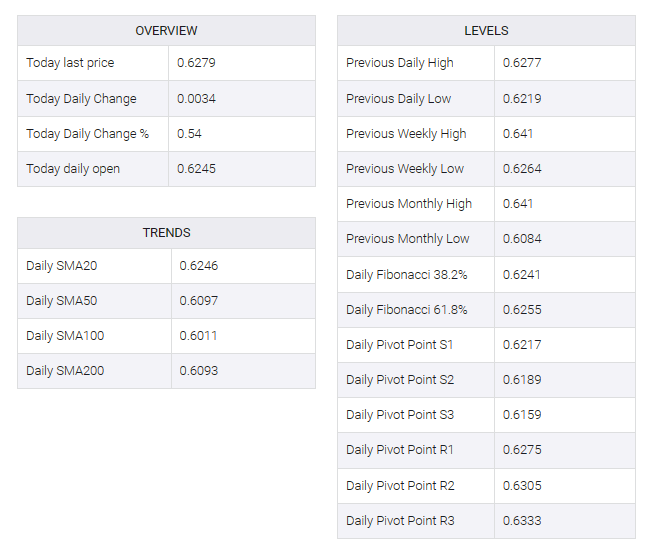

NZD/USD recovered its recent losses, trading higher near 0.6280 during the European session on Thursday. However, the NZD/USD pair faces challenges as the US dollar improves on market caution.

The 14-day Relative Strength Index (RSI) is above the 50 level, signaling a bullish sentiment. This suggests that the NZD/USD pair could potentially retest the key 0.6300 level. A move above the latter could push the NZD/USD pair past the weekly high at 0.6329 and key resistance at the 0.6350 level.

The placement of the Moving Average Convergence Divergence (MACD) line above the center line, combined with the divergence below the signal line, suggests a possible shift towards a bearish sentiment in the NZD/USD pair. Traders can probably watch and wait for confirmation from this lagging indicator to verify the possible downward trend of the pair.

On the downside, the 23.6% Fibonacci retracement at 0.6260 appears as immediate support followed by key levels at 0.6250 and the 21-day exponential moving average (EMA) at 0.6244. A break below this support zone could influence the NZD/USD pair to test the psychological support at 0.6200 after the 38.2% Fibonacci retracement at the 0.6167 level.