-

NZD/USD gathers strength for an ascending triangle pattern breakout ahead of Fed policy.

-

The NZ economy is seen growing by 0.5% in Q2 vs. a contraction of 0.1%, recorded for the January-March quarter.

-

The US Dollar Index remains subdued as the Fed is expected to keep interest rates unchanged at 5.25-5.50%.

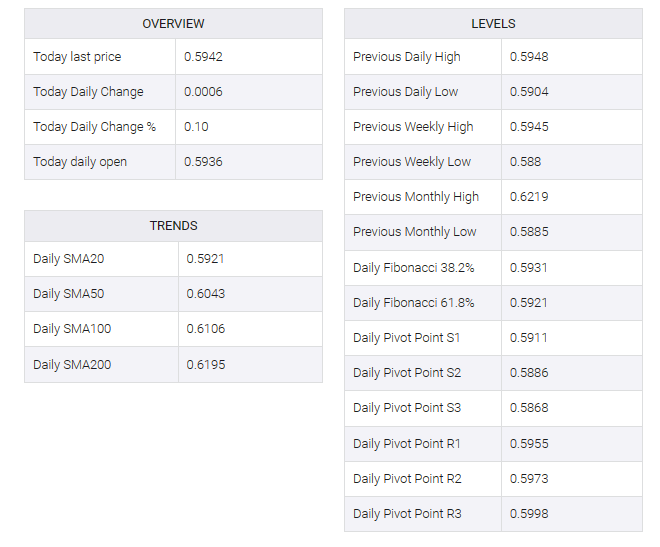

The NZD/USD pair trades sideways in a narrow range of 0.5932-0.5944 in the European session. The Kiwi asset struggles for a direction as investors await the interest rate decision from the Federal Reserve (Fed), which is expected to remain unchanged.

S&P500 futures made marginal gains in the London session. However, the overall market mood is calm ahead of the Fed policy meeting. The US Dollar Index (DXY) remains flat as the Fed is expected to keep interest rates unchanged at 5.25-5.50%, but bearish guidance cannot be ruled out.

Meanwhile, the New Zealand dollar will remain in effect ahead of Q2 gross domestic product (GDP) data. As expected, the NZ economy grew 0.5% versus the 0.1% contraction recorded for the January-March quarter. Annual GDP is seen accelerating at a slower pace of 1.2%. The previous reading was 2.2%.

NZD/USD attempts a breakout of the ascending triangle chart pattern formed on the two-hour scale. Horizontal resistance of the aforementioned chart pattern is plotted at the September 6 high at 0.5942 while the upward-sloping trend is held at the September 7 low at 0.5847.

The 20-period exponential moving average (EMA) at 0.5932 is providing a cushion to the New Zealand dollar.

Meanwhile, the Relative Strength Index (RSI) (14) tries to move into the bullish range of 60.00-80.00. If the RSI (14) does so, a bullish momentum will be triggered.

Going forward, a decisive break above September 14 high at 0.5945 would expose the asset to August 23 high around 0.5980, followed by August 8 low around 0.6035.

On the contrary, a breakdown below September 13 low at 0.5980 would drag the major toward September 7 low at 0.5847. A slippage below the latter would expose the asset to the round-level support at 0.5800.