-

NZD/USD finds sell-off near 0.6300 as focus shifts to US core PCE price index data.

-

A sticky US core PCE report could offer some support to the US Dollar.

-

The Kiwi pair trades in an upward-sloping chart pattern.

The NZD/USD pair faced selling pressure near the round-level resistance of 0.6300 in the early London session. The Kiwi asset is expected to remain weak ahead of key US personal consumption price index (PCE) data for November, due out at 13:30 GMT.

Investors see mild softness in core inflation data as interest rates are on a restrained path by the Federal Reserve (Fed). Monthly core PCE data rose at a steady pace of 0.2%, according to estimates. Annual core PCE data is expected to decline to 3.3%. The previous reading was 3.5%.

The US Dollar Index (DXY) returned to key support at 101.80 on deepening expectations of a rate cut by the Federal Reserve (Fed).

Meanwhile, the Reserve Bank of New Zealand (RBNZ) is expected to keep interest rates high for longer, with the New Zealand dollar continuing to outperform against the US dollar.

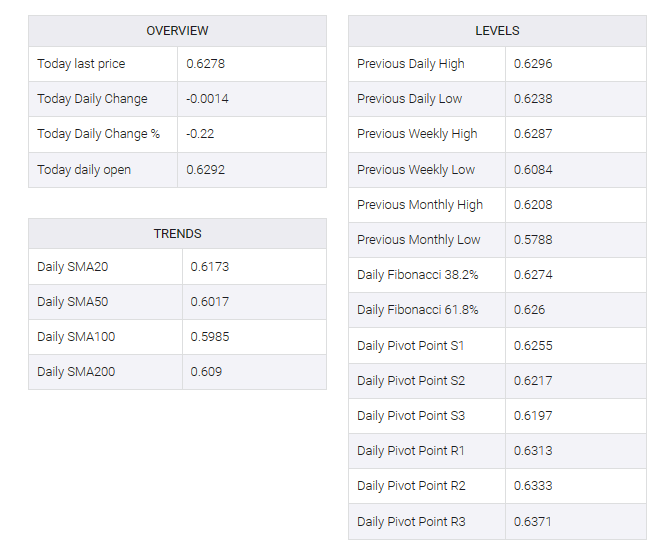

NZD/USD trades in a rising channel chart pattern on the two-hour scale where each pullback is viewed as a buying opportunity by market participants. The upward sloping 20-period exponential moving average (EMA) at 0.6256 will continue to provide support to the New Zealand dollar bulls.

If the Relative Strength Index (RSI) (14) manages to confidently move into the bullish range of 60.00-80.00, a bullish momentum will emerge.

The NZD/USD pair may witness a fresh rally after a decisive break above Wednesday’s high of 0.6300. The same event would allow it to refresh its five-month high near 0.6350. Further upside would expose it towards the July 14 high of 0.6400.

On the contrary, a breakdown below December 14 low near 0.6168 would drag the asset towards November 30 low near 0.6121, followed by December 13 low near 0.6084.