-

NZD/USD drifts lower for the second straight day and is pressured by a combination of factors.

-

The uncertainty over the Fed’s rate-hike path prompts some follow-through USD short covering.

-

China’s economic woes take its toll on the risk sentiment and weigh on the risk-sensitive Kiwi.

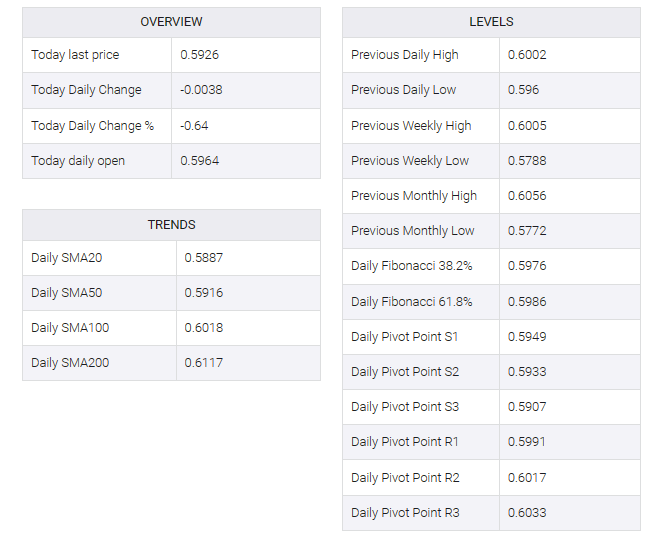

The NZD/USD pair extended the previous day’s rejection slide from the 0.6000 psychological mark, or near a four-week high, and remained under heavy selling pressure for a second straight day on Tuesday. The spot price extended its downtrend through the first half of the European session and fell to a two-day low near the 0.5915 region in the final hour.

The US dollar (USD) gained some follow-through traction and recovered further from its lowest levels since touched on Monday, September 20, which, in turn, is seen as a key factor in the drag on the NZD/USD pair. Federal Reserve (Fed) officials on Monday gave a mixed signal on the path of future rate-hikes. This, along with a generally weaker risk tone, is seen as based on the safe-haven greenback and driving away the risk-sensitive New Zealand dollar (NZD).

Fed Governor Lisa Cook noted that the central bank’s current target interest rate is sufficient to bring inflation back to the Fed’s 2% target. It has reiterated expectations that the Fed has completed raising interest rates. In contrast, Minneapolis Fed President Neil Kashkari said the U.S. economy has proven to be very resilient and that tightening will not return inflation to 2% in a reasonable amount of time. This raises uncertainty over the Fed’s next policy move and prompts USD short covering.

Global risk sentiment, meanwhile, took a hit in response to rather dismal Chinese trade balance data, which indicated that the recovery in the world’s second-largest economy remains uneven. Indeed, the General Administration of Customs reported that China’s trade surplus fell to $56.53 billion from $77.71 billion in October — its worst level since May 2022. This, added, raises concerns about the worse-than-expected slide in exports. Foreign demand.

That said, a fresh leg down in US Treasury bond yields could prevent USD bulls from placing aggressive bets and provide some support to the NZD/USD pair. Traders may also prefer to wait for new indications about the Fed’s policy outlook. Therefore, the focus will be on speeches by influential FOMC members, including Fed Chair Jerome Powell’s appearances on Wednesday and Thursday, which will play a key role in driving near-term USD demand.

In the meantime, Tuesday’s release of Trade Balance data from the US, along with the broader risk sentiment, will be looked upon to grab short-term trading opportunities around the NZD/USD pair. The aforementioned fundamental backdrop, meanwhile, seems tilted in favour of bearish traders and supports prospects for a further depreciating move for spot prices amid expectations that the Reserve Bank of New Zealand (RBNZ) will keep its policy rate unchanged in November.