-

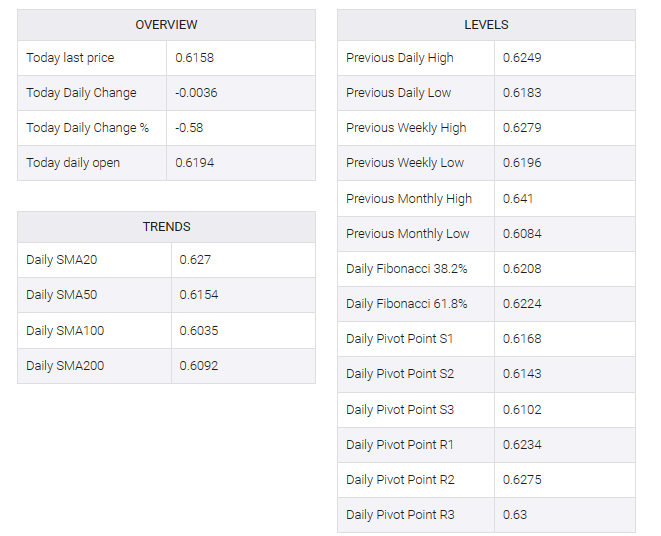

NZD/USD has plunged to near 0.6150 on downbeat market sentiment.

-

Investors project that the US Retail Sales grew by 0.4% vs. 0.3% increment in November.

-

RBNZ Conway is expected to push back market expectations of early rate cuts.

The NZD/USD pair has printed a fresh monthly low near 0.6150 in the early New York session. The Kiwi asset has faced a sharp sell-off as investors have rushed towards safe-haven assets amid deepening crises in the Middle East region and uncertainty about when the Federal Reserve (Fed) will start its rate-cut cycle.

The S&P500 is expected to open on a bearish note, given the negative signal from overnight futures. Market mood is downbeat as Iran-backed Houthi rebels have threatened to strike back at US military airstrikes in Yemen.

Meanwhile, the US dollar index (DXY) looks firm near fresh weekly highs near 103.20 as market participants review strong bets supporting a rate cut by the Fed in March. Investors have been wary of the Fed’s interest rate cuts since March after December inflation data came in tighter than estimated.

In addition, Atlanta Fed President Raphael Bostick said it was too early to talk about a rate cut because inflation’s progress back toward the 2% target had slowed.

Investors are awaiting US retail sales data for December, which will be released on Wednesday. Economic data is expected to show an increase of 0.4% against a 0.3% increase in November.

On the New Zealand Dollar front, investors await the speech from Reserve Bank of New Zealand (RBNZ) policymaker Paul Conway in which he is expected to push back market expectations supporting a rate cut sooner. The inflation in the New Zealand economy is significantly higher than what required by RBNZ policymakers, which would allow them to maintain a restrictive stance.