-

NZD/USD experiences pressure despite upbeat data from New Zealand.

-

Kiwi Consumer Confidence improved to 91.9 in November from 88.1 prior.

-

RBNZ Deputy Governor Christian Hawkesby said on Friday, “High and sticky core inflation leaves little room for error.”

-

China’s Caixin Manufacturing PMI rose to 50.7 and defied the anticipated decline to 49.8.

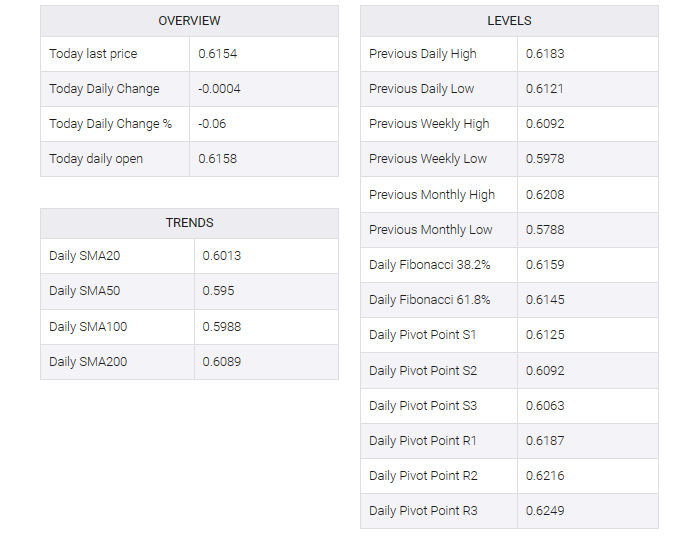

NZD/USD trims its intraday gains, still trading higher near 0.6160 during the Asian session on Friday. The NZD/USD pair received upward support as the US Dollar (USD) drifted lower on the back of subdued US bond yields. Additionally, New Zealand’s Roy Morgan Consumer Confidence released for November by the ANZ, showed that consumer confidence improved to 91.9 from 88.1 prior. The improved data could have supported the Kiwi pair’s strength.

Furthermore, slightly hawkish comments from Reserve Bank of New Zealand (RBNZ) Deputy Governor Christian Hawkesby could provide support for the New Zealand Dollar (NZD). “High and sticky core inflation leaves little room for error,” Hawksby said on Friday. Deputy Governor Hawkesby is also concerned that some measures of inflation expectations have risen. New Zealand could benefit from a period of restrained spending. Most borrowers are currently able to manage their debt at current interest rate levels.

In November, China’s Caixin manufacturing PMI beat expectations, rising to 50.7 and defying an expected decline to 49.8 from the previous reading of 49.5. This unexpected positive turn in the data is likely to support and strengthen the Kiwi dollar given the economic dynamics between China and New Zealand.

The US dollar index (DXY) faces a challenge as US bond yields dampen the reaction to recent gains. Mixed US data helped the greenback gain ground. The US Core Personal Consumption Expenditures Price Index (PCE) showed a MoM drop to 3.5% in October, down from the previous reading of 3.7%. In the labor market, initial jobless claims for the week ended Nov. 24 totaled 218K, slightly below expectations of 220K. These indicators provide insight into inflation trends and the health of the labor market, which influence economic assessments and potential policy decisions.

The upcoming release of the US ISM Manufacturing PMI for November and the speech by US Federal Reserve (Fed) Chairman Jerome Powell on Friday are events that can significantly influence market dynamics. Investors will be keenly observing these developments as they can play a pivotal role in shaping the trajectory of the US Dollar. Powell’s remarks, in particular, may provide insights into the Fed’s stance on monetary policy and its outlook on the economic landscape.