-

NZD/USD grapples to gain ground after retreating from a five-month high at 0.6298.

-

Improved US data showed positive signs for the US economy, providing support for USD.

-

Investors await US GDP data for further impetus on the US economy.

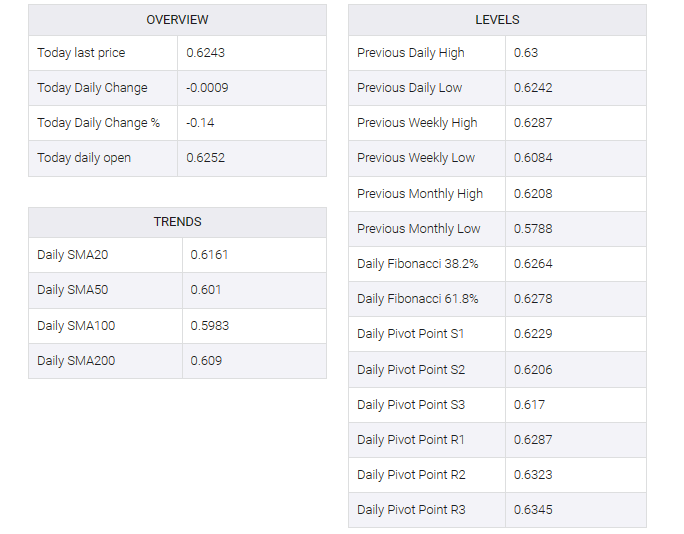

NZD/USD held its position below 0.6250 in early European hours on Thursday, struggling to recover its recent losses recorded on Wednesday. The NZD/USD pair rebounded from a five-month high reached at 0.6298 in the previous session, which could be attributed to improved economic data from the United States (US).

A rebound in existing home sales and a significant increase in consumer confidence are both positive signs for the US economy. US existing home sales change indicated a significant monthly rate increase of 0.8% in November, hanging on from a previous decline of 4.1%. CB Consumer Confidence however saw a significant increase in December, rising to 110.07 from 101.0.

A decline in the US Dollar Index (DXY) despite higher Treasury yields suggests investors are keeping a close eye on the Federal Reserve’s stance. Dovish sentiment regarding the path of interest rates seems to be influencing market speculation. DXY traded around 102.40, as of press time, with 2-year and 10-year yields on U.S. bond coupons bidding 4.38% and 3.88%, respectively.

On the Kiwi side, on Wednesday, improved consumer confidence data helped underpin the New Zealand dollar (NZD) against the US dollar (USD). Reserve Bank of New Zealand (RBNZ) Governor Adrian Orr’s cautious outlook and acknowledgment of the journey ahead, particularly with high inflation levels, reflects the complexity of navigating the economic landscape.

On Thursday, Kiwi Credit Card Spending (YoY) showed an increase of 3.3% in November, versus the 2.8% drop in October. On the United States docket, investors await the US Gross Domestic Product Annualized (Q3), Initial Jobless Claims, and the Philadelphia Fed Manufacturing Survey.