-

NZD/USD retreats from the three-month high at 0.6086.

-

US Dollar gains ground on improved US bond yields.

-

Fed is open to tightening policy further if the inflation target fails to be met.

-

The positive China’s outlook supports the rise in the New Zealand Dollar.

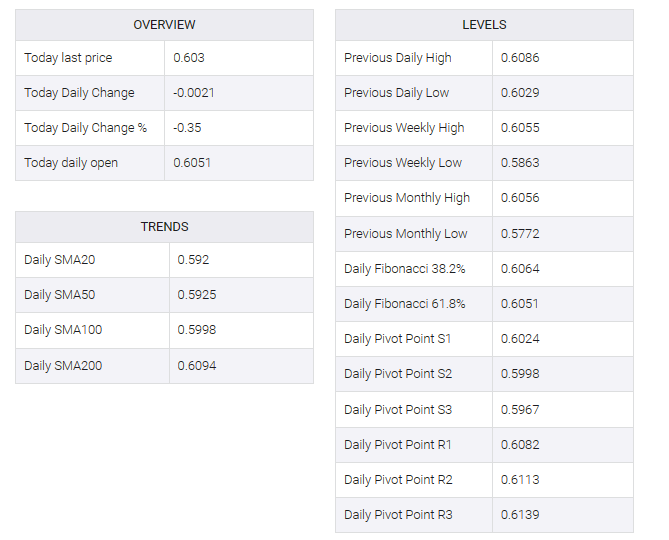

NZD/USD snapped a three-day winning streak after retreating from a three-month high of 0.6086, which can be attributed to a rise in the US dollar (USD). The NZD/USD pair traded near 0.6030 in the early European session on Wednesday.

Greenback feels strength as US Treasury yields improve. At the time of writing the 10-year and 2-year US bond yields stood at 4.41% and 4.88% respectively. The US dollar index (DXY) is higher near 103.70.

The Federal Open Market Committee (FOMC) expressed a modestly hawkish tone in Tuesday’s meeting minutes, which could provide some upside support for the buck. FOMC committee members expressed the possibility of further tightening of monetary policy in the event that new data fails to show the Federal Reserve’s (Fed) inflation target. The board also decided that policy should be tightened for a little while longer, or until inflation clearly and steadily declines toward the committee’s target.

On Tuesday, New Zealand’s trade balance was $-14.81 billion YoY in October compared to $-15.41 billion in September. Meanwhile, the country’s imports fell to $7.11 billion from the previous reading of $7.20 billion, while exports fell to $5.40 billion from $4.77 billion.

Moreover, the positive outlook for China, its main trading neighbor, is supporting a rise in the New Zealand dollar (NZD). A representative of the People’s Bank of China (PBOC) reiterated their determination to provide additional policy support to the country’s weak real estate industry.

Investors will likely monitor data from the United States (US) on Wednesday, including weekly jobless claims and the Michigan Consumer Sentiment Survey. On the Kiwi docket, third-quarter retail sales are expected to show improvement in Friday’s release.