SwissFS Advantages

high leverage The maximum leverage of 1:400 is suitable for all trading styles. This being said that, the higher ratio will only give you the opportunity to risk more. If you’re seeking a higher standard, take a look at XM with their 1:888.

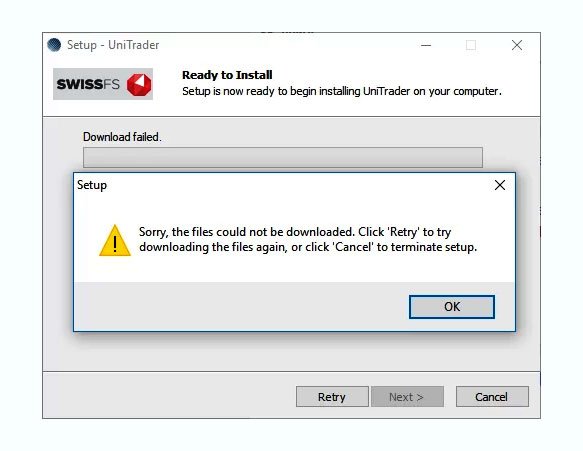

Two platforms are accessible The two trading platforms, SwissFS, MetaTrader4 and UniTrader which will be suitable for most investors. MT4 is by far the most well-known forex trading software that is highly regarded by traders of all kinds. In addition to the attractive charting it also comes with hundreds of customized technical indicators as well as automatic trading platforms (better called Expert Advisors). Here’s a sneak peek of one offered by SwissFS:

We will also discuss the second platform in the negatives section since it is not without its flaws.

A partnership with a legally regulated company This is likely the most important selling point for SwissFS. We aren’t certain of the conditions of their transactions however, it leaves uncertain impressions.

SwissFS Disadvantages

None of the financial regulations By the way, SwissFS is not regulated by any relevant agency. They claim that they are supervised through the Kuwait Chamber of Commerce, however, this isn’t an equivalent to other financial regulatory authorities similar to those of FCA. Brokers operating located in Kuwait has to register with the Capital Markets Authority (CMA).

Problems with one of the platforms We experienced issues with UniTrader. UniTrader platform. We hope this is an intermittent issue.

Large minimal lot size The amount of 0.10 (or 10000 dollars) per transaction is quite large. Many brokers provide 0.01 and some, such as FXTM offering even lower deals through cent accounts. This is crucial for those looking to take on less funds, because it will allow for better risk management.

Spreads that are wide fixed The spread levels that, despite the fact that they aren’t listed on the site, aren’t comparable. The EUR/USD spread on the MT4 platform was fixed and was launched at 3 pip. Click here to view brokers that offer more favourable spreads.

Fixed spreads aren’t very widespread nowadays, but If you’re looking to explore this kind or trading method, one the best deals is offered through EasyMarkets. If you place a deposit greater than $250, you’ll receive a EUR/USD spread which is fixed by 1 pip.

There is no information about the minimum deposits This isn’t important, but some would like to know about the threshold for entry at SwissFS. Many brokers have set such minimum amounts (probably because of the administrative cost for establishing a real account) which range from $100 to $100. This being said the highest-rated broker and spread betting service IG is a good choice for customers regardless of the initial capital.

Conclusion

SwissFS is a broker in the forex market that causes mixed reactions. SwissFS is based in Kuwait however, it is not subject to the supervision of the CMA. However, they have a partnership with BMFN which is a strictly controlled firm.

In the final day, the expenses of trading with SwissFS are significantly more expensive than average offer. The spread should not be the primary concern As we’ve mentioned earlier, it’s not an “totally regulated” company.

In order to illustrate our argument, we would be able to show you the major advantages of working with a broker that is supervised by the Australian Securities and Investments Commission (ASIC) since their associates are registered with this agency.

To register a broker on the Commission one has to first possess capital holdings of at least 1 million AUD. This is a requirement put to be in place to deter fraudsters (which the market of online trading is filled with) from being able to register. A business that has such funds is better positioned to enjoy a longer-term plan.

Furthermore, all client funds are stored in “segregated accounts”. This is a form of bank account, and is only available subject to certain guidelines. The broker cannot just access your funds and then take it.

| SwissFS Summary | |

|---|---|

| SwissFS Details | Information |

| Regulators | |

| Country |  Kuwait Kuwait |

| Base Currencies | USD |

| Type Of Brokers | N/A |

| Trading Platform | N/A |

| Established Year | 2010 |

| Website Language | English |

| US Clients | |

| SwissFS Spreads | |

|---|---|

| Option | Information |

| Minimum Spreads | 3.0 |

| Commission | |

| Fixed Spreads | |

| SwissFS Payment & Withdrawal Option | |

|---|---|

| Option | Information |

| Acc Funding Methods |  PayPal, PayPal,  Wire transfer Wire transfer |

| Acc Withdrawal Methods |  Wire transfer, Wire transfer,  PayPal PayPal |

| SwissFS Suitable For | |

|---|---|

| Option | Information |

| Publicly Traded | |

| Beginners | |

| Day Trading | |

| Weekly Trading | |

| Professionals | |

| Swing Trading | |

| SwissFS Trading Account Options | |

|---|---|

| Option | Information |

| Maximum Leverage | 1:200 |

| Mini Account | |

| VIP Accounts | |

| Segregated Accounts | |

| Free Demo Accounts | |

| Managed Accounts | |

| Pro Account | |

| Minimum Deposit | $500 |

| Islamic Account | |

| SwissFS Trading Services | |

|---|---|

| Option | Information |

| Hedging | |

| News Trading | |

| Scalping | |

| Automated Trading | |

| Indices | |

| Commodities | |

| Forex instruments | |

| CFDs | |

| ETFs | |

| Stocks | |

| Bonds | |

| Cryptocurrencey | |

| Trading Signals | |

| Educational Service | |

| Copy Tradings | |

| SwissFS Contact & Support | |

|---|---|

| Option | Information |

| Telephone No | +965-22020490 |

| admin@swissfs.com | |

| 24 Hours Support | |

| Support During Weekends | |

| Address | City Tower (Al Madina Tower) Floor 16 Khalid Ibn Al Waleed Street Sharq Kuwait P.O.BOX 26635, SAFAT 13127 |