Education

TMGM Academy is a special feature that TMGM provides in addition to its customer support. The TMGM Academy teaches you all about forex trading. There are three levels: Beginner Stage (Intermediate Stage), Intermediate Stage (Advanced Stage). It is composed of three stages:

- This stage is for beginners. It prepares you to start forex trading. The Beginner Stage provides a solid foundation, including understanding margin trading and how to read different types of charts. It also introduces trading instruments, oscillators and indicators.

- The Intermediate Stage of TMGM Academy focuses on technical aspects of forex trading. This includes indicators such as MACD, RSI and ATRs. TMGM also introduces Fibonacci analysis and Fundamental analysis. It also demonstrates effective ways to use them in trading.

- The Advanced stage at the TMGM Academy allows traders to dive into different trading strategies and learn how they can be applied. This stage teaches advanced Fibonacci extensions, retracements, correlation and trade management.

Is TMGM a fraud or safe?

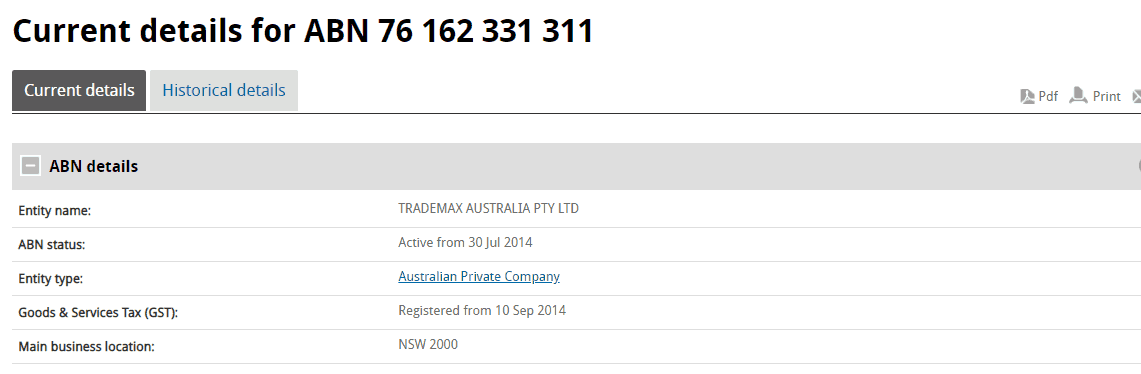

TMGM is a safe broker for trade because of its regulatory status. Trademax Australia Limited, a financial service company regulated under the Australian Securities and Investments Commission, adheres to strict standards. ASIC regulations are among the most stringent worldwide. They ensure stability and client protection by following strict guidelines.

A TradeMax Global Limited entity is also available that falls under Vanuatu‘s laws, which are an offshore zone. Although we don’t recommend trading with offshore brokers because of the lack of requirements, TradeMax holds an additional license that is trusted and it is safe to trade.

What can you do to be protected?

There are many rules that brokerage must follow before it can establish capital requirements. These should be in line with robust risk management and internal procedures. They also need sufficient cash equivalence to ensure broker’s reliability. All client funds are kept in a trust account at National Australia Bank (NAB). The investors that fall under the Professional Indemnity Insurance which covers the compensation for broker’s insolvency.

Trade Platforms

The group has many subsidiaries that offer a wide variety of products to suit different trading preferences. There are more than 100 currencies, Commodities and Indices, Futures as well as Cash DMA Stocks, Options Bonds, and Futures. All of these products can be accessed through the trading platform. The most popular MT4 is available via PC, Mobile, and Web versions.

The inbuilt platform IRESS is also available. IRESS is a better option than MetaTrader 4, if you intend to trade shares. IRESS allows for trades on exchanges in the United States, Australia and the United Kingdom.

IRESS also offers market depth and exchange pricing. This is possible because IRESS uses Direct Market Access trading. DMA is Level 2 Market Depth Or Book Pricing. This means that you can see live orders from institutional liquidity providers connected with the exchange. MetaTrader 4 doesn’t offer DMA.

You should be aware that the minimum deposit fee is $5,000 USD. IRESS is only for serious traders. You will need an IRESS Account to use IRESS. Because DMA trading is primarily for professionals traders, there are no minimum deposits required for IRESS. There will be a wide range of costs depending on the stock exchange. Below are the costs for US stock markets.

Account

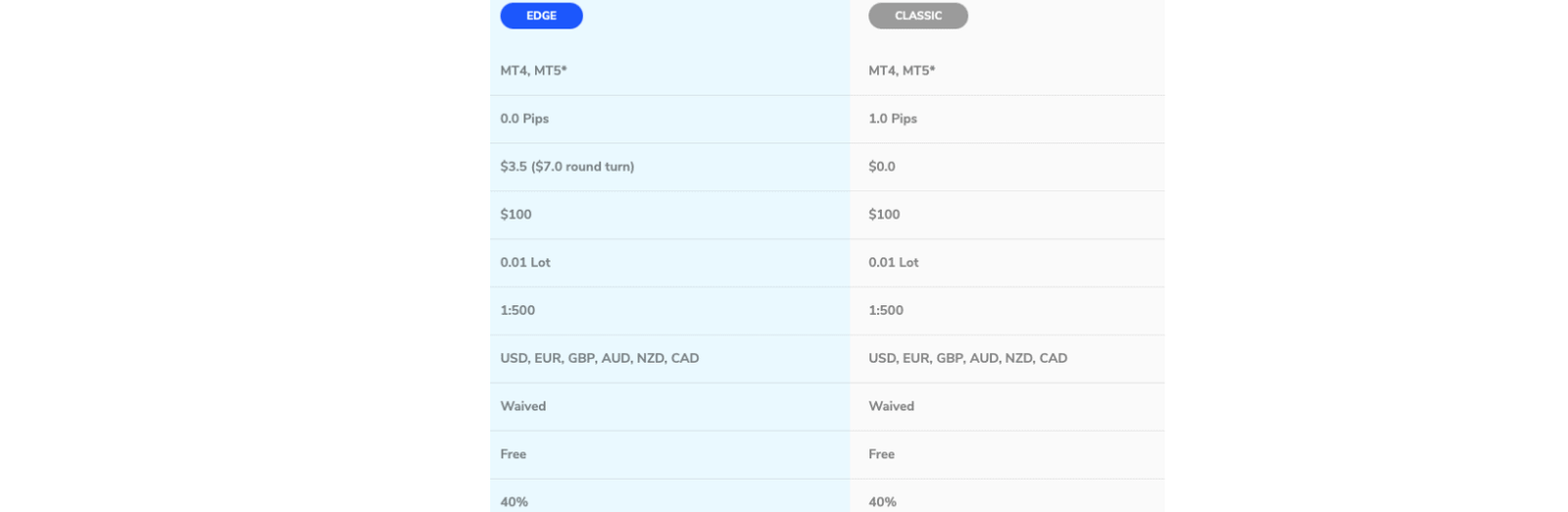

TMGM offers several trading accounts. They provide the functionality and features you require, regardless of your trading experience. TMGM offers a variety of trading accounts that will suit your needs, whether you are a long-term investor and a day trader. You can choose between a or TMGM Classic account , or a /TMGM Edge account .

Spreads starting at 1 pip are available with the Classic account type of TMGM. Because they are already part of the spread, there are no commission fees. If you prefer to use long-term, spread-dependent strategies, the Classic account type is for you. The following are some of the Classic account features:

- No commission

- Minimum 0.01 lot size

- Execution of ECN

- Hedging and scalping permitted

- No cost funding

- Base currencies are: USD, CAD and EUR.

The TMGM Edge account has the lowest spreads and starts at 0 pips. Each standard lot will be subject to a $7 round-turn commission ($3.50 one-way). Edge trading is the account closest to ECN trading, since there is no dealing desk. ECN pricing is possible because spreads are sourced directly from liquidity providers without any interference by TMGM. This account type is ideal for traders who want the tightest spreads possible.

Swap-free account

TMGM offers a Swap-Free account if you are unable to pay interest or pay your deposit due to religious beliefs. Swap-Free accounts can only be opened for Edge accounts. They require a $100 minimum deposit, and a minimum lot size of 0.01 lots.

Demo Account

TMGM offers demo accounts that allow you to trade before you sign up for an account. You can practice trading with virtual money, which allows you to familiarize yourself more fully with the broker’s services and features. This allows you to learn as much about TMGM as you can before you open a trading account.

The MetaTrader 4 trading platform allows demo accounts to have access for 365 days. Your access to the platform will be terminated if you have not been active for six consecutive months. Your demo account can be funded with one of three amounts: $5,000, $10,000 or $50,000.

Leverage

Leverage allows you to make money from fluctuations in forex rates by trading with a multiplied trading volume, as opposed to your initial balance. The broker may lend leverage to traders to increase potential gains. However, it is important to learn how to use the tool well and not take on the greatest risk.

The amount of leverage available will vary depending on whether you trade from Australia/New Zealand, or elsewhere.

- ASIC regulates TMGM in Australia. The maximum leverage allowed for Major forex pairs is 1:30, while the limit for Minor pairs is 1:20. This is consistent with European and UK regulators. If you are a professional trader on TMGM, these numbers jump to 1:1400 for Major and Minor forex pairs.

- FMA regulates TMGM in New Zealand. Forex leverage maximum is 1:30

- If you trade with TMGM but are not a resident of these two countries, the maximum leverage for forex trading is 1:500

Deposit and Withdrawal Options

Multiple secure payment methods are available to fund your account. These include no transaction fee, Cards payments and BankWire transfer. It is the choice of the trader. This means that all transactions to and from your trading account will be made in the chosen currency, making it easier.

What is the minimum deposit required to purchase TMGM?

The minimum deposit required to open an account is $100. However, trades may require higher amounts. You will still have to meet margin requirements. Although the Classic account doesn’t charge a commission you will experience higher spreads. Edge accounts, on the other hand, require a $7 fee for commissions and have tighter spreads. No matter what account type you choose, ECN execution will be available with a minimum lot size of 0.01.

Conclusion

The TMGM review found that the brokerage Group was reliable and compliant with regulations. TMGM also maintained safe trading operations in accordance with the strict requirements of ASIC. Investors are therefore protected by many measures.

We would love to hear your opinion on TMGM. Please share your experiences with us or refer to our comments area for additional information.

| TMGM Summary | |

|---|---|

| TMGM Details | Information |

| Regulators | ASIC, VFSC, FMA |

| Country |  Australia Australia |

| Base Currencies | USD, NZD, GBP, EUR, CAD, AUD |

| Type Of Brokers | ECN |

| Trading Platform | Mobile, WebTrader, MT4, MT5, HubX, Lress |

| Established Year | 2013 |

| Website Language | English, Arabic, Chinese, Vietnamese, Ukrainian, Turkish, Thai, Spanish, Russian, Romanian, Portuguese, Korean, Japanese, Italian, Indonesian, Hindi, German, French |

| US Clients | |

| TMGM Spreads | |

|---|---|

| Option | Information |

| Minimum Spreads | N/A |

| Commission | |

| Fixed Spreads | |

| TMGM Payment & Withdrawal Option | |

|---|---|

| Option | Information |

| Acc Funding Methods |  UnionPay, UnionPay,  Skrill, Skrill,  Neteller, Neteller,  FasaPay, FasaPay,  Master Card, Master Card,  Visa Card, Visa Card,  Wire transfer Wire transfer |

| Acc Withdrawal Methods |  Skrill, Skrill,  Neteller, Neteller,  UnionPay, UnionPay,  FasaPay, FasaPay,  Master Card, Master Card,  Visa Card, Visa Card,  Wire transfer Wire transfer |

| TMGM Suitable For | |

|---|---|

| Option | Information |

| Publicly Traded | |

| Beginners | |

| Day Trading | |

| Weekly Trading | |

| Professionals | |

| Swing Trading | |

| TMGM Trading Account Options | |

|---|---|

| Option | Information |

| Maximum Leverage | 1:500 |

| Mini Account | |

| VIP Accounts | |

| Segregated Accounts | |

| Free Demo Accounts | |

| Managed Accounts | |

| Pro Account | |

| Minimum Deposit | 100 USD |

| Islamic Account | |

| TMGM Trading Services | |

|---|---|

| Option | Information |

| Hedging | |

| News Trading | |

| Scalping | |

| Automated Trading | |

| Indices | |

| Commodities | |

| Forex instruments | |

| CFDs | |

| ETFs | |

| Stocks | |

| Bonds | |

| Cryptocurrencey | |

| Trading Signals | |

| Educational Service | |

| Copy Tradings | |

| TMGM Contact & Support | |

|---|---|

| Option | Information |

| Telephone No | +61 2 8036 8388 |

| support@tmgm.com | |

| 24 Hours Support | |

| Support During Weekends | |

| Address | Level 28, One International Tower 100 Barangaroo Avenue, 2000 Sydney NSW Australia |

Vanuatu

Vanuatu Liechtenstein

Liechtenstein