TNFX Advantages

High leverage levels

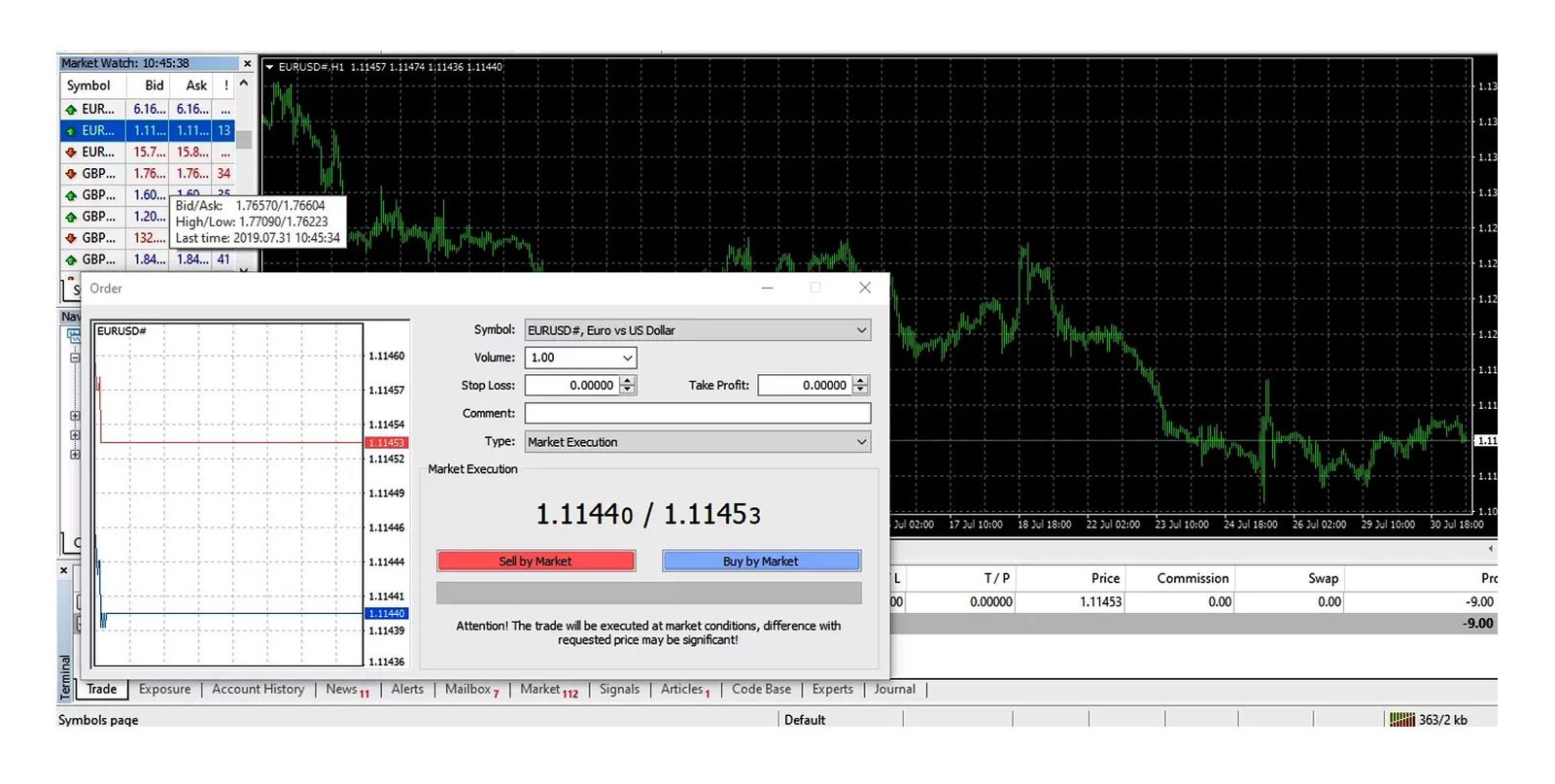

When we created an account for demo purposes with TNFX to test their offerings, we discovered the spread for the most liquid currency pair EUR/USD, hovering between 1.3 pip, as stated on the site of the broker. The costs for trading are within the industry average.

Zoom in to see more.

Keep in mind that a variety of brokers have comparable or lower spreads. A lot of them, in contrast to TNFX are also licensed.

In addition, customers of this broker can to open positions of a large size due to the large leverage levels offered, which can reach 1:400. However, we recommend novice traders to learn about the potential risks involved in the margin trading prior to.

Trading on the MT4

Also, we must mention as a potential benefit of TNFX its fact clients can access the most popular trading platform for forex, Metatrader 4 (MT4).

The MT4 is extremely popular due to its being extremely robust, flexible and simple to use. It has a powerful charting software, a broad variety of technical indicators built-in and automatic trade option (EAs) as well as a robust back-testing capabilities.

TNFX Disadvantages

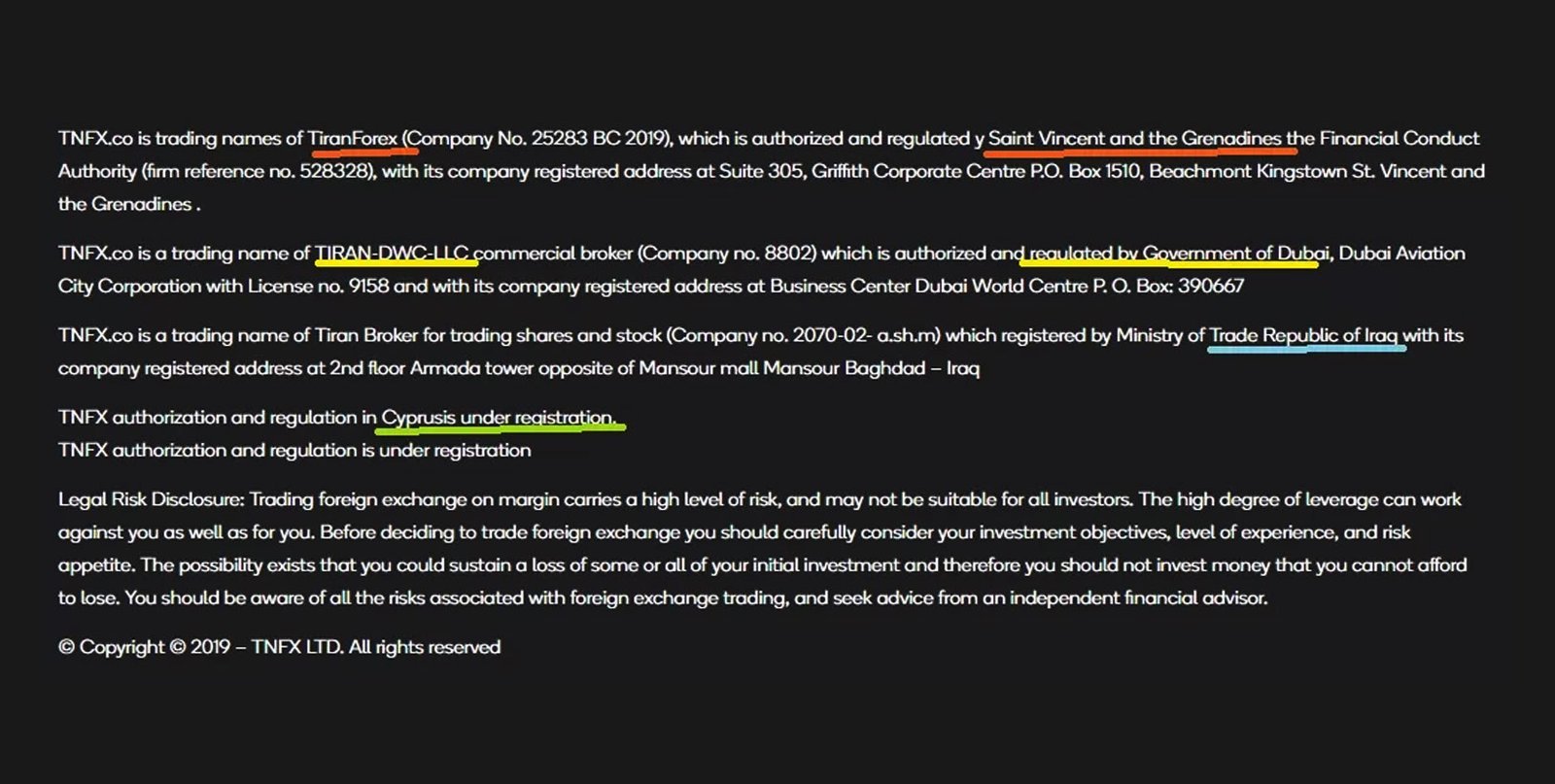

False claims about regulation

There are a number of brokers making a variety of statements on their website regarding the nature of their financial regulatory however the situation of TNFX is unique. The company claims to be legally regulated by Saint Vincent and the Grenadines (SVG), Dubai, Iraq and has also sought a license in Cyprus.

Click the image to see it in the entire size.

To make matters more complex To make matters even more complicated, the broker’s Terms & Conditions refer to another business, TNFX Global Limited, along with Belize’s financial regulator The IFSC.

It turns out that none of these claims are accurate. It is the SVG Financial Services Authority (FSA) has made clear that it does not grant licenses nor supervise financial services providers. The Forex brokerages operating in Dubai have been placed under the oversight under the supervision of Dubai Financial Services Authority (DFSA) which is not the government in the manner that TNFX suggests. Similar to financial service providers, those in Iraq are controlled through the Iraqi Securities Commission, and not the Ministry of Trade. None of these governmental organizations such as CySEC in Cyprus has ever granted an authorization to TNFX.

Therefore, the individuals who operate the company try to deceive clients into believing that TNFX is legitimate and regulated broker, when they’re actually not subject to any regulatory authority from any government. That means that the clients (or those who are victims) of the broker are exposed to a significant risk. There is no one to go to in the event they have legitimate complaints.

Initial deposit a bit high

Another thing we don’t love concerning TNFX is that the broker requires an initial investment of $300. Although this might not seem as a lot, a number of legitimate and licensed brokers demand lower amounts. One example is that one can get a new account with the the market leading IG by making a deposit of only a few pounds.

Conclusion

The world of trading is full of fraudsters trying to scam investors everywhere And the majority of them present false information about corporate (and trading) information, or not even. It is obvious, TNFX is the first class.

We urge our readers to only deposit money at licensed and regulated firms and ensure that the business they plan to fund is legally able to provide financial services in the manner it advertises. That is how you can limit the chance of a foul-play. If you’d prefer to trade with the peace of mind knowing in the knowledge that your broker’s trustworthy and your funds are secure Choose a broker that is licensed by a credible financial authority such as ASIC within Australia and The FCA within the UK for instance.

| TNFX Summary | |

|---|---|

| TNFX Details | Information |

| Regulators | |

| Country |  Saint Vincent and the Grenadines Saint Vincent and the Grenadines |

| Base Currencies | USD, EUR |

| Type Of Brokers | ECN, STP |

| Trading Platform | Desktop, Mobile, MT4 |

| Established Year | 2019 |

| Website Language | English, Arabic |

| US Clients | |

| TNFX Spreads | |

|---|---|

| Option | Information |

| Minimum Spreads | 0.4 |

| Commission | |

| Fixed Spreads | |

| TNFX Payment & Withdrawal Option | |

|---|---|

| Option | Information |

| Acc Funding Methods |  Wire transfer, Wire transfer,  Visa Card, Visa Card,  Master Card Master Card |

| Acc Withdrawal Methods |  Wire transfer, Wire transfer,  Visa Card, Visa Card,  Master Card Master Card |

| TNFX Suitable For | |

|---|---|

| Option | Information |

| Publicly Traded | |

| Beginners | |

| Day Trading | |

| Weekly Trading | |

| Professionals | |

| Swing Trading | |

| TNFX Trading Account Options | |

|---|---|

| Option | Information |

| Maximum Leverage | 1:400 |

| Mini Account | |

| VIP Accounts | |

| Segregated Accounts | |

| Free Demo Accounts | |

| Managed Accounts | |

| Pro Account | |

| Minimum Deposit | $300 |

| Islamic Account | |

| TNFX Trading Services | |

|---|---|

| Option | Information |

| Hedging | |

| News Trading | |

| Scalping | |

| Automated Trading | |

| Indices | |

| Commodities | |

| Forex instruments | |

| CFDs | |

| ETFs | |

| Stocks | |

| Bonds | |

| Cryptocurrencey | |

| Trading Signals | |

| Educational Service | |

| Copy Tradings | |

| TNFX Contact & Support | |

|---|---|

| Option | Information |

| Telephone No | 80080010 |

| support@tnfx.co | |

| 24 Hours Support | |

| Support During Weekends | |

| Address | Suite 305, Griffith Corporate Centre P.O. Box 1510, Beachmont Kingstown St. Vincent |