-

USD/CAD extends the previous day’s rebound from six-week low.

-

WTI crude fell half a percent to $74.90 amid dire economic forecasts from the World Bank.

-

Risk catalysts could direct intraday moves ahead of Thursday’s US inflation data.

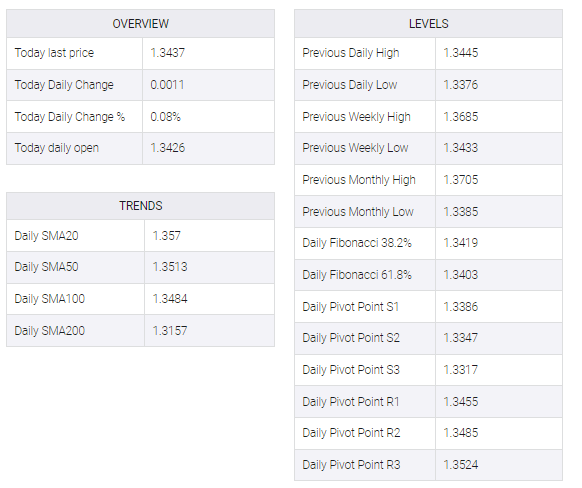

USD/CAD picks up bids to refresh intraday high near 1.3440 while stretching the previous day’s rebound from a 1.5-month low during early Wednesday. In doing so, the Loonie pair fails to portray the US Dollar’s weakness as prices of Canada’s main export item, WTI crude oil, return to the bear’s radar after a brief absence.

That said, WTI crude oil drops 0.50% to $74.90, printing the first loss-making day in three, as energy traders fear slower demand due to the likely taxing economic transition. The reason could be linked to the World Bank’s downbeat economic forecasts.

On Tuesday, the World Bank (WB) came out with its revised economic forecast and hinted at favoritism towards the traditional haven US dollar, which depends on commodity prices. That said, the WB said it expects the global economy to grow 1.7% in 2023, sharply lower than the 3% forecast in June, as reported by Reuters. The Washington-based institute also raised fears of a global recession, citing the scale of the recent recession.

It should be noted that Federal Reserve (Fed) Chair Jerome Powell’s inability to provide guidance and clarify the US central bank’s next steps at the Riksbank’s International Symposium on Tuesday added a pullback to US Treasury yields weighing on the US dollar index. That said, the DXY remained dull near 103.30 as the US 10-year Treasury yield faded from Tuesday’s rebound from a three-week low.

Elsewhere, market sentiment remains sluggish, as portrayed by the mostly unchanged S&P 500 Futures, as traders await the key inflation data from China and the US. Also likely to have probed the USD/CAD traders could be the absence of any important comments from Bank of Canada (BOC) Governor Tiff Macklem during the previous day’s Riksbank event.

Moving on, the inflation data will be crucial for short-term USD/CAD directions but the risk catalysts shouldn’t be ignored.

Technical analysis

USD/CAD needs to remain beyond the 100-day EMA level of 1.3430 to keep the buyers on board.