-

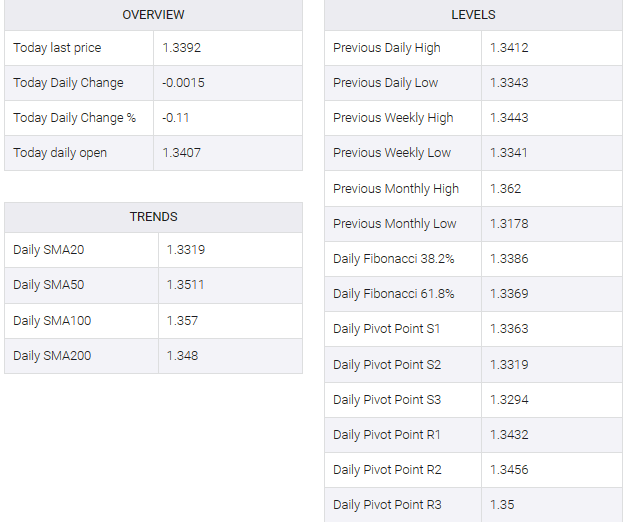

USD/CAD trades on a softer note near 1.3391 on the softer USD.

-

The swaps market anticipates nearly 175 basis points (bps) of Federal Reserve (Fed) easing this year.

-

The Bank of Canada (BoC) is widely expected to start cutting interest rates this year after a series of rate hikes.

-

The Canadian Consumer Price Index (CPI), and US Retail Sales for December will be in the spotlight this week.

The USD/CAD pair remained capped below the 1.3400 mark during early European trading hours on Monday. The pair’s downtick was supported by a decline in the US dollar (USD) and a weak US Producer Price Index (PPI) report. The pair is currently trading near 1.3391, up 0.19% on the day.

Expectations of Federal Reserve (Fed) easing remain elevated. According to WIRP, markets have cut rates to around 85% at their March meeting versus 75% earlier last week. Additionally, the swaps market expects the Fed to ease about 175 basis points (bps) this year, compared to less than 150 bps earlier last week. US December retail sales data will be in the spotlight on Wednesday. The headline figure is projected to show 0.3% to 0.4% MoM growth in November.

On the loonie front, the Bank of Canada (BoC) is expected to start cutting interest rates this year after a series of rate hikes. The first rate cut could be as early as this spring. WIRP proposes that a rate cut be fully priced in at its April meeting, with about 150 bps of total rate cuts for this year. Meanwhile, the Canadian Consumer Price Index (CPI) for December on Tuesday may give some indication of further monetary policy from the BoC. Headline inflation is expected at 3.1% to 3.3% YoY in November

Later on Monday, Canadian wholesale sales, manufacturing sales, and the Bank of Canada Business Outlook survey will be released. On Tuesday, market players will be eyeing the December Canadian Consumer Price Index (CPI). Focus will shift to December’s US retail sales on Wednesday. Traders will take cues from these statistics and find trading opportunities around the USD/CAD pair.