-

A combination of supporting factors lifts USD/CAD to a four-day high on Wednesday.

-

Tumbling Oil prices undermines the Loonie and acts as a tailwind amid a stronger USD.

-

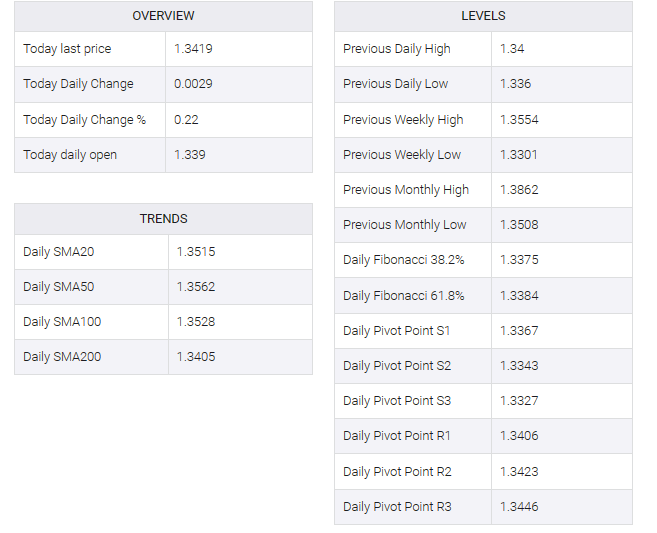

Acceptance above the 200-day SMA supports prospects for additional intraday gains.

The USD/CAD pair held fresh bids on Wednesday and climbed to a four-day high near the 1.3425 region in the first half of the European session. The spot price, for now, seems to have found acceptance above the technically significant 200-day Simple Moving Average (SMA) and support has come from a combination of factors.

A combination of factors weigh heavily on the Canadian dollar, which, along with a modest US dollar (USD) uptick, acts as a tailwind for the USD/CAD pair. Despite falling US inventories and firm Chinese economic data, oil prices hit fresh monthly lows amid concerns that rising borrowing costs will slow economic growth and reduce fuel demand. In addition, signs of cooling consumer inflation in Canada weakened the commodity-linked loonie.

The US dollar, on the other hand, found support from a further rise in US Treasury bond yields, bolstered by the prospect of further policy tightening by the Federal Reserve (Fed). Indeed, markets have almost completely priced in a 25 bps lift-off in May, and Fed funds futures indicate a small chance of another rate hike in June. That pushed yields on the benchmark 10-year U.S. government bond and the rate-sensitive two-year Treasury note to multi-week highs.

The latest leg up, meanwhile, confirms a breakout through the 200-day SMA, which, along with the aforementioned supportive

fundamental backdrop suggests that the path of least resistance for the USD/CAD pair is to the upside. In the absence of any relevant market-moving economic data on Wednesday, either from the US or Canada, investors will focus on the release of the Fed’s Beige Book, due later during the US session, for the central bank’s take on the state of the US economy.

This, along with the US bond yields, will drive the USD demand and provide some impetus to the USD/CAD pair. Traders will further take cues from the official US Crude inventory report by the Energy Information Administration (EIA), which should influence Oil price dynamics and contribute to producing short-term opportunities around the major.