-

USD/CAD retreats from the 1.3475 supply zone and is pressured by a combination of factors.

-

Crude Oil prices jump to a two-week high and underpin the Loonie amid a modest USD slide.

-

Divergent Fed-BoC outlook, recession fears lend support ahead of Canadian jobs data.

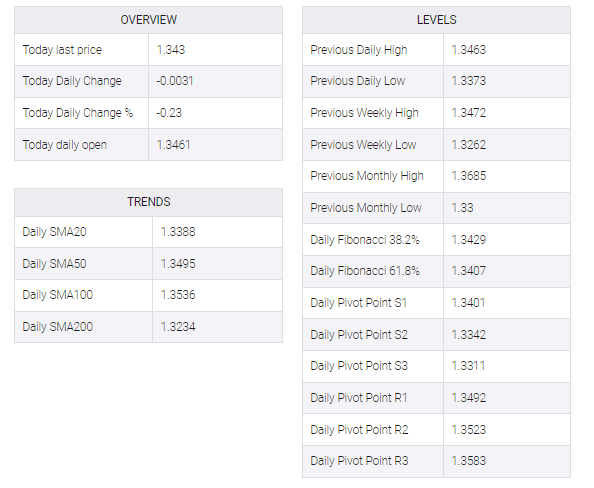

The USD/CAD pair continues with its struggle to make it through the 1.3475 resistance zone and attracts some intraday selling on Friday. The intraday downfall drags spot prices to a fresh daily low, around the 1.3430 area during the first half of the European session and is sponsored by a combination of factors.

Crude Oil prices regain strong positive traction and jump back closer to the 100-day SMA resistance, hitting a two-week high. This, in turn, is seen underpinning the commodity-linked Loonie, which, along with a modest US Dollar pullback, exerts some downward pressure on the USD/CAD pair. That said, any meaningful downside seems elusive, warranting some caution for bearish traders before positioning for any further intraday depreciating move.

Concerns about a deep global economic recession could act as a headwind for the black liquid and put a lid on any optimism in the market. In addition, the expectation of further policy tightening by the Fed favors USD bulls and the possibility of some deep-buying emerging around the USD/CAD pair. Indeed, several FOMC members, including Fed Chair Jerome Powell, have emphasized the need for additional rate hikes to control inflation.

The Bank of Canada (BoC), on the other hand, is expected to be the first major central bank to pause the policy-tightening cycle following eight rate hikes in the past 11 months. The divergent Fed-BoC outlook on future rate hikes adds credence to the positive bias. Traders, however, might refrain from placing aggressive directional bets around the USD/CAD pair and prefer to wait for the release of the latest Canadian monthly employment details.

Investors will further take cues from the release of the Preliminary Michigan Consumer Sentiment Index from the US. This, along with Fed Governor Christopher Waller’s speech and the broader risk sentiment, might influence the USD. Apart from this, Oil price dynamics should contribute to producing short-term trading opportunities around the USD/CAD pair. Nevertheless, spot prices seem poised to end in the positive territory for the second successive week.