-

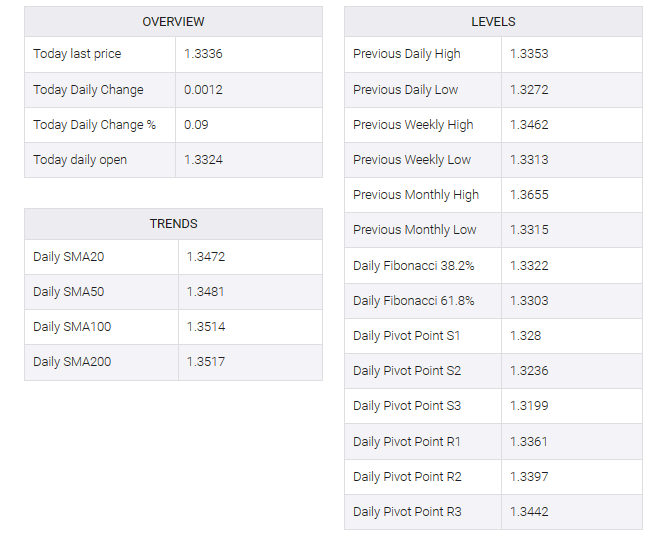

USD/CAD has sensed stiff barricades around 1.3350 as the USD Index has witnessed exhaustion in the upside momentum.

-

Optimism inspired by a skip in the rate-hiking spree by the Fed was offset by caution generated due to hawkish interest rate guidance.

-

The Canadian Dollar is going to show some action after the release of monthly Manufacturing Sales data.

The USD/CAD pair has sensed offers near the immediate resistance of 1.3350 in the early European session. The Loonie asset is losing strength despite more interest rate hikes by the Federal Reserve (Fed) will keep the policy divergence space of the US central bank with other global banks.

Nominal losses added to Asia by S&P500 futures were borne in Europe as optimism inspired by a skip in the Fed’s rate-hiking spree was offset by caution generated by interest rate guidance.

Earlier, the US Dollar Index (DXY) pared its full losses and rose above 103.30 as Fed Chair Jerome Powell confirmed that more interest rate hikes are on the way but now struggles to maintain strength. Investors should note that US headline inflation has softened critically, but core inflation is still showing resilience due to tight labor market conditions.

Fed Powell noted in his monetary policy statement that “core PCE inflation does not see much improvement.” and “Core PCE to decline decisively.”

The Fed’s hawkish dot plot has affected demand for US government bonds. This led to a sharp jump in the 10-year US Treasury yield to around 3.83%.

The Canadian dollar is set to show some movement following the release of Canada’s monthly manufacturing sales data (April). Economic data expected a contraction of 0.2% versus an expansion of 0.7%. It appears that higher interest rates by the Bank of Canada (BOC) have forced firms to use less of their full capacity, which has reduced overall factory activity.

On the oil front, oil prices showed recovery action after a correction near $68.00 as the USD index met offers. It is worth noting that Canada is an oil exporter to the US and higher oil prices will strengthen the Canadian dollar.