-

USD/CAD attracts some intraday selling on Tuesday, though the downside remains limited.

-

An uptick in Oil prices underpins the Loonie and exerts pressure amid renewed USD selling.

-

Hawkish Fed expectations warrant caution before positioning for any meaningful decline.

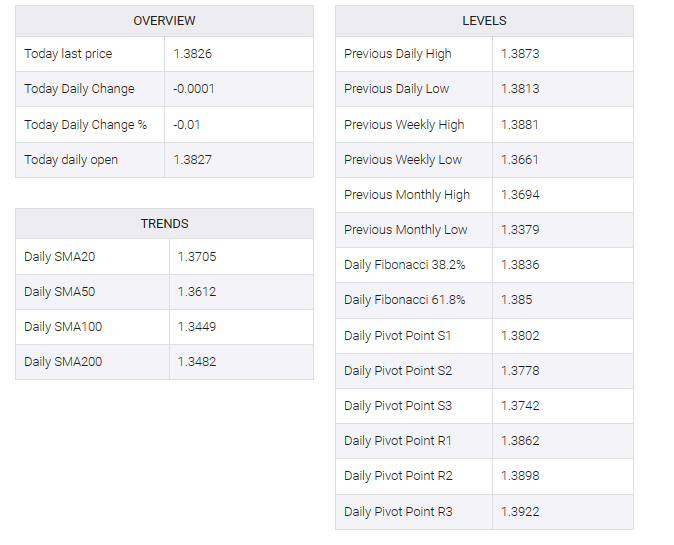

The USD/CAD pair attracts fresh sellers following an intraday uptick to mid-1.3800s and drops to a fresh daily low during the first half of the European session. Spot prices, however, manage to hold above the 1.3800 round figure and seem poised to prolong over a three-week-old uptrend.

A slight increase in crude oil prices is seen underpinning the commodity-linked loonie. Apart from this, a general positive tone around the equity markets dragged the safe haven US dollar (USD) to one-week lows, which in turn, appears to put some pressure on the USD/CAD pair. Any meaningful corrective decline, however, still appears elusive ahead of the key central bank event risk – the outcome of the highly-anticipated two-day FOMC monetary policy meeting starting this Tuesday.

The Federal Reserve (Fed) is set to announce its decision on Wednesday and is widely expected to hold its benchmark interest rate at 5.25%-5.50%, or the highest range in 22 years. That said, US economic resilience, along with still sticky inflation, should allow the US central bank to leave the door open for another rate hike in 2023. The hawkish outlook favors higher US Treasury bond yields, which should support the rupee and the USD/CAD pair.

Additionally, investors are worried about the deteriorating economic conditions in China, the world’s top oil importer. This, along with concerns that headwinds from rapidly rising borrowing costs could dampen fuel demand, put a lid on any meaningful upside for crude prices. In addition, Bank of Canada (BoC) Governor Tiff McCollum’s dovish signal last week, indicating that interest rates have peaked, should contribute to limiting the downside of the USD/CAD pair.

Next to tap is the US economic docket – followed by the release of the Chicago PMI and the Conference Board’s Consumer Confidence Index later in the North American session. In addition to this, US bond yields will drive USD demand, which along with oil price dynamics will provide some impetus to the USD/CAD pair. Nevertheless, the fundamental background mentioned above suggests that the path of least resistance for spot prices is to the upside.