-

USD/CAD discovers buying interest near 1.3200 despite a sell-off in the US Dollar.

-

The Canadian Dollar has weakened due to a significant fall in the oil price.

-

Oil prices fell sharply as commercial shipments resumed from Red Sea route.

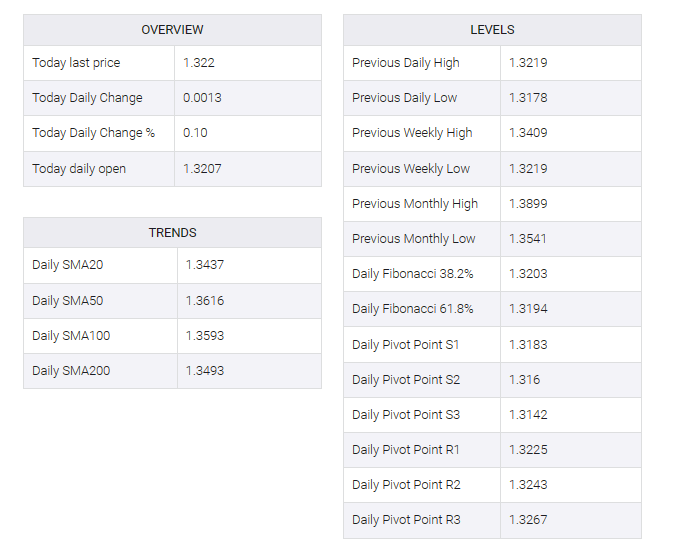

The USD/CAD pair found a cushion near the round-level support of 1.3200 in the European session. The loonie edged closer to 1.3220 amid a sharp sell-off in oil prices due to higher inventories and the resumption of oil shipments from the Red Sea route in the week ended December 22.

West Texas Intermediate (WTI), futures on the NYMEX, fell 1.5% to close at $73.00 on Thursday. Oil prices suffered a sharp sell-off following the formation of a US-led maritime task force to protect commercial oil tankers against Houthi attacks.

Along with the recovery in trade from the Red Sea, higher oil inventories have weighed heavily on oil prices. The United States Energy Information Administration (EIA) reported on Wednesday that crude inventories were higher by 1.8 million barrels.

It is worth noting that Canada is an oil exporter to the United States and low oil prices depend on the Canadian dollar.

Meanwhile, S&P500 futures added some gains in the London session, reflecting an improvement in market participants’ risk-appetite. The US dollar index (DXY) printed a fresh five-month low near 100.60. The USD index is struggling for a firm position as investors are betting on a rate cut by the Federal Reserve (Fed) from March 2024.

During the festive season, the economic calendar is very light, so the second-tier weekly initial jobless claims data will be closely watched by market participants. Next week, employment data from Canada and the US will be crucial.