-

USD/CAD drifts higher on the firmer US Dollar.

-

The Bank of Canada (BoC) maintained its key overnight rate unchanged at 5.0%.

-

ADP private payrolls climbed 103K in November versus 106K prior.

-

Canadian Building Permits for October and US weekly Jobless Claims will be due later on Thursday.

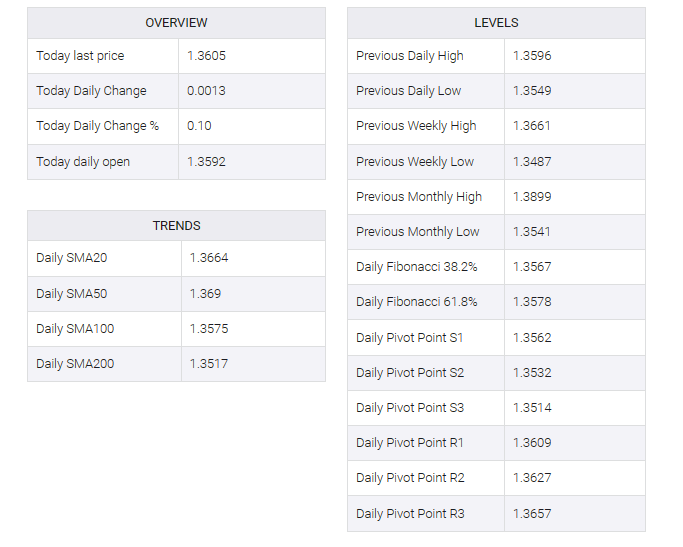

The USD/CAD pair trades on a stronger note during the Asian trading hours on Thursday. The rebound of the pair is bolstered by renewed US Dollar (USD) demand and the decline of oil prices. At press time, USD/CAD is trading at 1.3605, down 0.09% on the day.

On Wednesday, the Bank of Canada (BOC) kept its overnight rate unchanged at 5.0% at its December meeting, opening the door to additional rate hikes. The central bank cited a slowing economy and declining price pressures such as consumer spending as evidence that tighter monetary policy is helping to reduce inflation.

Money markets expect a rate cut in early March, with a 25 basis point (bps) cut by April. However, BoC Governor Tiff Macklem said the central bank is not even considering easing as inflation is above target.

Analysts, on the other hand, expect the tightening cycle to be complete and the Fed to keep interest rates on hold until at least July, later than previously thought. Data released Wednesday revealed ADP private payrolls rose 103K in November versus 106K a year earlier, weaker than market estimates of 130K.

Looking ahead, market participants will be keeping an eye on Canadian building permits for October. Also, US weekly jobless claims data is due, which is expected to gain 222,000. US employment data will be the highlight on Friday. Nonfarm payrolls (NFP) are estimated to have added 185K jobs in November and the unemployment rate is expected to hold steady at 3.9%. These data can give a clear direction to the USD/CAD pair