-

USD/CAD oscillates in a narrow trading band and is influenced by a combination of forces.

-

An uptick in Oil prices underpins the Loonie and caps the upside amid subdued USD demand.

-

Traders look forward to important macro data from the US and Canada for a fresh impetus.

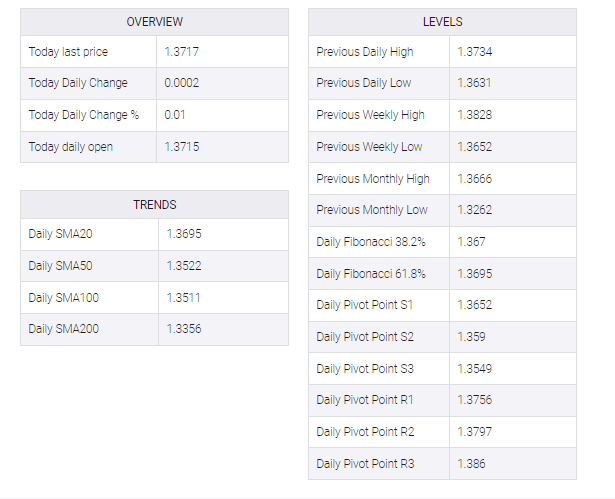

The USD/CAD pair struggles to capitalize on the previous day’s goodish rebound from the 1.3630 area, or over a two-week low and oscillates in a narrow trading band through the early European session on Friday. The pair is currently placed just above the 1.3700 mark, though a combination of factors keeps a lid on any meaningful upside.

Crude oil prices regained positive traction amid fears that rising tensions in the Middle East could disrupt supplies, particularly after US airstrikes on Iran-backed groups. This, in turn, underpins the commodity-linked loonie, which acts as a headwind for the USD/CAD pair, along with US dollar (USD) price action. Indications of a pause in interest rate hikes by the Federal Reserve failed to help the greenback recover from its lowest level since February 03 overnight.

It is noteworthy that the US central bank raised interest rates by 25 bps on Wednesday, as widely expected, although the outlook was cautious given the recent turmoil in the banking sector. This comes on the back of the recent sudden collapse of two mid-sized US banks – Silicon Valley Bank and Signature Bank. The Fed also cut its median forecast for real GDP growth projections for 2023 and 2024, keeping US Treasury bond yields and the USD depressed.

Apart from this, a generally positive tone around equity markets is seen as another factor weighing on safe haven stocks. That said, growing market concerns that slowing economic growth will dampen fuel demand will dampen oil price gains. The USD/CAD pair should lend support, with Bank of Canada (BoC) expected to refrain from raising interest rates, driven by softer-than-expected Canadian consumer inflation data released on Tuesday.

From a technical perspective, the two-way price moves within a familiar range witnessed since the beginning of the current week, indicating indecision among traders regarding the near-term trajectory. Furthermore, the aforementioned mixed fundamental backdrop calls for some caution before placing aggressive directional bets around the USD/CAD pair. Investors also seem reluctant ahead of key macro data from the US and Canada, later in North America’s first session.

Friday’s US economic docket features the release of durable goods orders and flash PMI prints, which will impact demand for the US dollar along with US bond yields and broader risk sentiment. Traders will take further cues from Canadian monthly retail sales figures. In addition, oil price dynamics will provide a fresh impetus to the USD/CAD pair and create short-term opportunities in the final days of the week.