-

USD/CAD oscillates in a range and is influenced by a combination of diverging forces.

-

Rising US bond yields act as a tailwind for the USD and lend some support to the pair.

-

An uptick in Crude Oil prices is seen underpinning the Loonie and capping the upside.

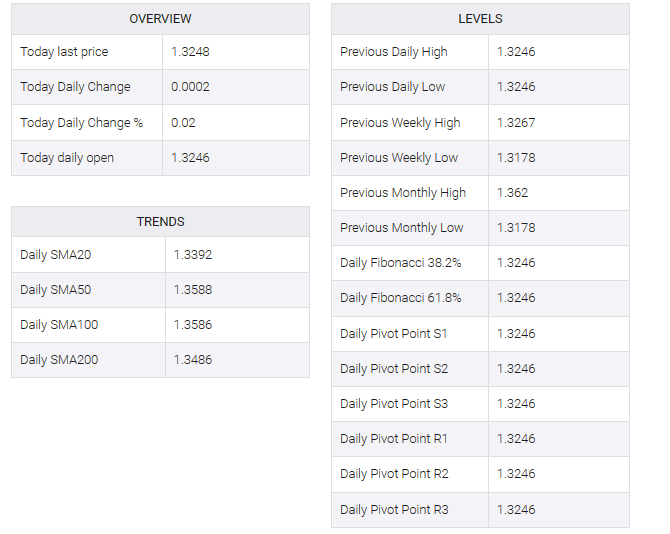

The USD/CAD pair struggled to gain any meaningful traction on Tuesday and oscillated in a narrow trading band during the Asian session. The spot price currently trades in the mid-1.3200 range, almost unchanged for the day amid mixed signals and relatively thin liquidity conditions.

A further recovery in US Treasury bonds helped the US dollar (USD) attract some buyers for the third day in a row, which, in turn, is seen as a key factor lending some support to the USD/CAD pair. That said, rising crude oil prices underpin the commodity-linked loonie and are seen acting as a headwind for spot prices. Additionally, dovish Federal Reserve (Fed) expectations could prevent USD bulls from placing aggressive bets and cap the main.

Investors seem confident and are pricing in a greater likelihood that the US central bank will start cutting interest rates as early as March. Bets were reaffirmed by a much-anticipated decline in the US Core Personal Consumption Expenditure (PCE) price index – the Fed’s preferred inflation gauge. This comes on top of a resilient US economy and ensures a soft landing in 2024, allowing the US central bank to ease its policy sooner rather than later.

Meanwhile, Bank of Canada (BoC) Governor Tiff McCollum recently said the central bank could also begin cutting rates sometime in 2024. This leaves the Canadian dollar (CAD) at the mercy of oil price dynamics and sentiment surrounding the greenback. Nevertheless, the mixed fundamental backdrop warrants some caution before positioning for a moderate bounce of the USD/CAD pair from the 1.3175 area or an extension to the five-month low touched last week.

Traders may prefer to wait on the sidelines ahead of key US macro releases scheduled for the start of a new month. This week’s busy US economic docket features the ISM Manufacturing PMI and JOLTS job openings on Wednesday, the ADP report on Thursday and the closely watched NFP on Friday. Investors will face the release of the FOMC minutes on Wednesday, which could signal the timing of the first rate cut.