-

USD/CAD drops to its lowest level since November and is pressured by a combination of factors.

-

Bullish oil prices underpin the loonie and act as a headwind amid prevailing USD selling bias.

-

The fundamental backdrop favours bearish traders and supports prospects for additional losses.

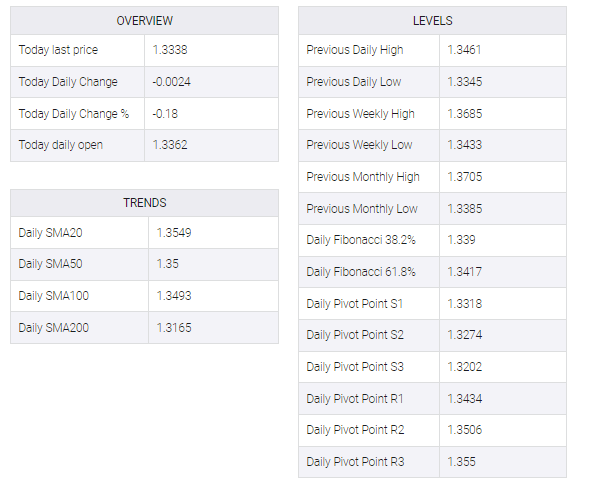

The USD/CAD pair attracts fresh sellers in the vicinity of the 1.3400 mark on Friday and drops to its lowest level since November 25 during the first half of the European session. The pair is currently placed just below mid-1.3300s, down around 0.15% for the day, and is pressured by a combination of factors.

Crude oil prices are trading with moderate gains near a week-and-a-half high on hopes that China will boost demand for the fuel away from its zero-COVID policy. This, in turn, appeared to underpin the commodity-linked loonie, which, with a prevailing US dollar selling bias, dragged the USD/CAD pair lower for a second day.

The USD Index, which measures the greenback’s performance against a basket of currencies, languishes near a seven-month low amid expectations that the Fed will soften its hawkish tone. The bets for smaller Fed rate hikes were lifted by the US consumer inflation figures and comments by several FOMC officials on Thursday.

In fact, the markets now seem convinced that the Fed will further slow the pace of its rate-hiking cycle and deliver a smaller 25 bps lift-off in February. This, in turn, keeps the US Treasury bond yields depressed near a multi-week low, which, along with a positive risk tone, continues to weigh on the safe-haven Greenback.

Traders now look to the US economic docket, featuring the release of the Preliminary Michigan Consumer Sentiment Index later during the early North American session. This, along with Oil price dynamics, could provide some impetus to the USD/CAD pair. Nevertheless, spot prices remain on track to end in the red for the fourth straight week.