-

USD/CAD picks up bids to pare day-start losses, reverses the previous day’s pullback from seven-week high.

-

Oil prices buoy hopes of economic recovery, geopolitical tensions amid sluggish session.

-

Talks surrounding Fed concerns join mixed moves of bond market to probe Loonie traders.

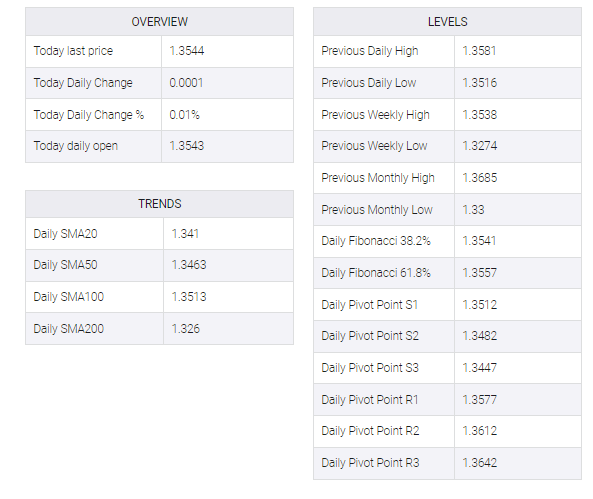

USD/CAD grinds near intraday high as it reverses the day-start losses, as well as dialing back the previous day’s u-turn from a seven-week high, around 1.3545, heading into Friday’s European session.

In doing so, the loonie pair fails to justify the firm price of Canada’s main export item, such as WTI crude oil. That said, black gold rose 0.65% intraday to $76.15 by press time, extending the previous day’s rebound from a two-week low. Looking at the reasons, recent strong figures from the US and Europe, as well as other major economies, add to China’s readiness to give the economy more output to prop up oil prices.

Additionally favoring the WTI bulls are the news suggesting more geopolitical tensions surrounding Russia and Ukraine, as well as the Sino-American tussles.

Elsewhere, the US Dollar Index (DXY) snaps a three-day uptrend as it grinds near 104.55 while DXY bulls struggle for clear directions after refreshing a seven-week high the previous day.

The US Dollar’s latest weakness could be linked to the dicey markets as the market’s fears that the strong US data and further Federal Reserve (Fed) rate hikes are already priced in. The same seemed to have weighed on the US Treasury bond yields. On the same line could be the mixed headlines surrounding China, due to its peace plan for Ukraine and ties with Russia, as well as due to the US-China readiness for trade talks, despite not sharing the details and criticizing each other on various issues.

Against this backdrop, the S&P 500 Futures fade recovery moves from the monthly low by retreating to 4,015, down 0.10% intraday at the latest. Further, the US 10-year Treasury bond yields seesaw around 3.86%, making it less active on the day, whereas the US two-year bond coupons stay inactive near 4.69% by the press time.

Given the dicey markets and cautious mood ahead of the key US data, namely the US Personal Consumption Expenditures (PCE) Price Index for January, the USD/CAD pair traders may witness lackluster moves ahead. However, hawkish hopes from the Fed’s preferred inflation gauge may not hesitate from disappointing the Loonie pair buyers if printing downbeat numbers.

Also read: US PCE Inflation Preview: Can the US Dollar turn bullish for good?

Technical analysis

Although Thursday’s bearish spinning top lures the USD/CAD sellers, the nearness to the 100-DMA support of 1.3510 and bullish MACD signals suggest limited downside room for the pair.