-

USD/CAD prints mild losses, holding lows near intraday lows of late.

-

WTI crude oil bears struggle for clear directions amid holiday mood, mixed sentiment.

-

The US Dollar shows a pullback in US Treasury yields amid inactive markets.

USD/CAD remains depressed around the intraday low of 1.3588 amid the quiet markets during early Thursday.

In doing so, the Loonie pair consolidates the biggest daily gains in a fortnight as the US Treasury yields weigh on the US Dollar. That said, the softer prices of WTI crude oil, Canada’s key export item, join the market’s mixed mood to restrict the quote’s immediate downside.

USD/CAD jumped the most in two weeks the previous day as doubts over China’s Covid statistics and methods of unlock seem to have challenged the previous optimism.

Reuters news that inconsistent virus details from Beijing and multiple economies announcing new testing requirements from China earlier weighed on market sentiment and drove up U.S. Treasury yields. “China reported three new Covid-related deaths for Tuesday, up from one for Monday – numbers inconsistent with what funeral parlors are reporting, as well as with the experience of much less populated countries after they reopen,” Reuters reported.

The UK recently joined the ranks of the US, South Korea, Japan, Taiwan, Italy and India in unveiling new Covid testing requirements for visitors from China.

On the other hand, Russia’s rejection of peace with Ukraine unless it accepts a deal to allow additional territories to join Moscow is weighing on market sentiment and protecting USD/CAD bulls despite the latest punback.

Elsewhere, WTI crude oil posted a 0.30% intraday loss around $78.50, falling for a third straight day, as demand fears over China-linked headlines added to Russia’s inability to address supply crunch issues.

Among those plays, S&P 500 futures saw around 3,810 with the US 10-year Treasury yield hitting 3.87% the previous day after its biggest increase since Oct. 19.

Looking forward, risk catalysts will be more important for clear directions while US Initial Jobless Claims will decorate the economic calendar.

Technical analysis

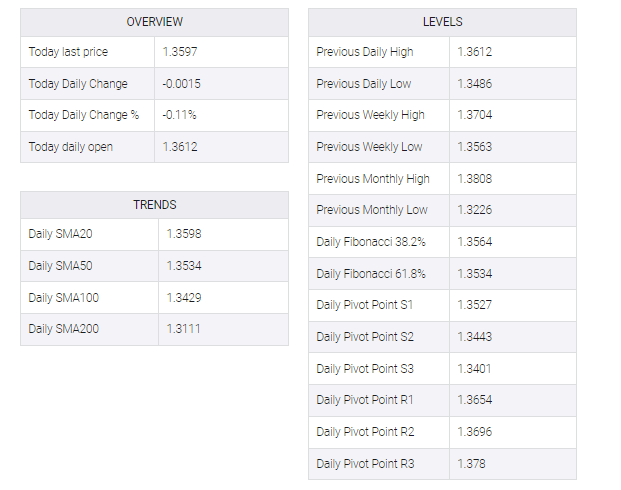

USD/CAD takes a U-turn from the previous support line stretched from mid-November, around 1.3615 by the press time. However, the 50-DMA level of 1.3530 acts as the short-term key support.