-

USD/CAD gained some positive traction on Thursday, although there is no bullish conviction.

-

Weaker crude oil prices seem to undermine the loonie and offer support to the pair.

-

Sliding US bond yields put USD bulls on the defensive and act as a headwind.

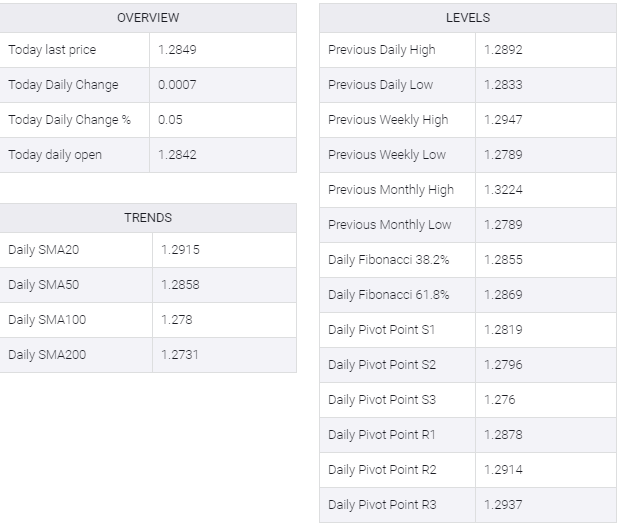

The USD/CAD pair attracts some buying near the 1.2835-1.2830 region on Thursday and reverses a part of the previous day’s retracement slide from a one-week high. The pair holds on to its modest gains through the early European session and is currently trading near the mid-1.2800s, up only 0.10% for the day.

Weak crude oil prices continue to weaken the commodity-linked loonie, which, in turn, lends some support to the USD/CAD pair. Investors worry that a slowdown in global growth will affect energy demand. That added, indications that current tight supplies are easing, with overnight data showing an unexpected rise in US crude and gasoline stockpiles, weighed on the commodity.

Despite the supporting factors, the USD/CAD pair seems to lack bullish conviction in the bearish US dollar. A weaker tone around US Treasury bond yields has been a key factor keeping USD bulls on the defensive. That said, taunting comments from several Fed officials this week, indicating that more interest rate hikes are on the way in the near term, should help limit any meaningful USD decline.

The fundamental backdrop favours bullish traders and supports prospects for some near-term appreciating move for the USD/CAD pair. Investors, however, seem reluctant and prefer to wait on the sidelines ahead of this week’s important macro data. The monthly jobs report from the US and Canada are scheduled for release on Friday, which should provide a fresh directional impetus to the USD/CAD pair.

In the meantime, traders on Thursday might take cues from the release of the Weekly Initial Jobless Claims, due later during the early North American session. This, along with the US bond yields and Fedspeak, might influence the USD demand. Apart from this, oil price dynamics should allow traders to grab short-term opportunities around the USD/CAD pair.