-

USD/CAD remains on the defensive, though a combination of factors helps limit losses.

-

BoC Governor sees rate cuts in 2024 and overshadows the recent bounce in Oil prices.

-

Fed officials push back against bets for early rate cuts and lend some support to the USD.

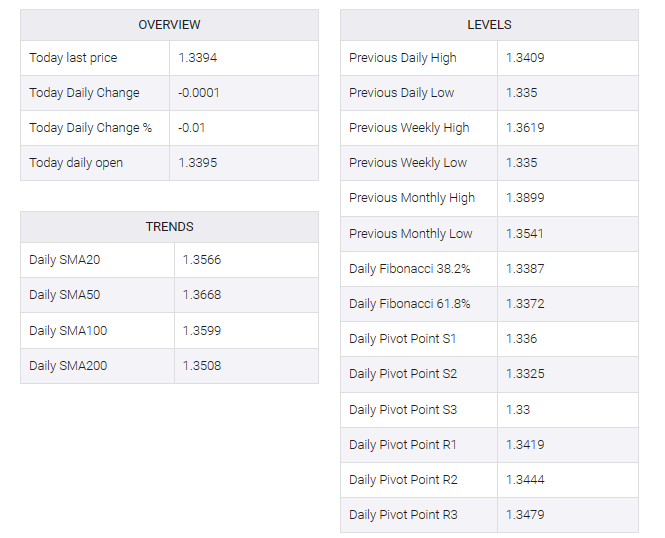

The USD/CAD pair struggled to capitalize on the previous day’s good bounce from the 1.3300 mid or three-month low and traded with a slight negative bias below the 1.3400 mark during the Asian session on Tuesday.

The downside, however, remains in the wake of dovish overnight comments from Bank of Canada (BoC) Governor Tiff McCollum, who said the central bank could begin cutting rates sometime in 2024. Markets reacted quickly and the BoC had expected to start easing as early as April with an incremental rate cut of at least 100 bps by the end of next year. Despite the recent good recovery in crude oil prices, which tends to benefit the commodity-linked loonie, this will act as a tailwind for the USD/CAD pair.

Apart from that, a moderate US dollar (USD) uptick will lend support to spot prices and limit any bearish moves. Chicago Federal Reserve (Fed) President Austin Goolsby, along with Cleveland Fed President Loretta Meister, pushed back against market bets on an initial interest rate cut on Monday. This comes on the back of comments by New York Fed President John Williams on Friday that it was premature to speculate on rate cuts. In addition to this, geopolitical risks benefit the USD’s relative safe haven status against its Canadian counterpart.

Meanwhile, traders seem reluctant to place aggressive directional bets around the USD/CAD pair and prefer to wait for the release of the latest consumer inflation data from Canada for fresh stimulus later in the North American session. In the US Economic Docket, meanwhile, is Housing Market Data – Building Permits and Housing Starts. In addition to this, a scheduled speech by Richmond Fed President Thomas Barkin will influence the USD, creating short-term trading opportunities along with oil price dynamics.