-

USD/CAD extends gains as fears over the Middle East situation escalate.

-

US Dollar faced resistance after Fed Chair Powell’s dovish remarks over interest rate trajectory.

-

Solid US economic figures provide support to underpin the Greenback.

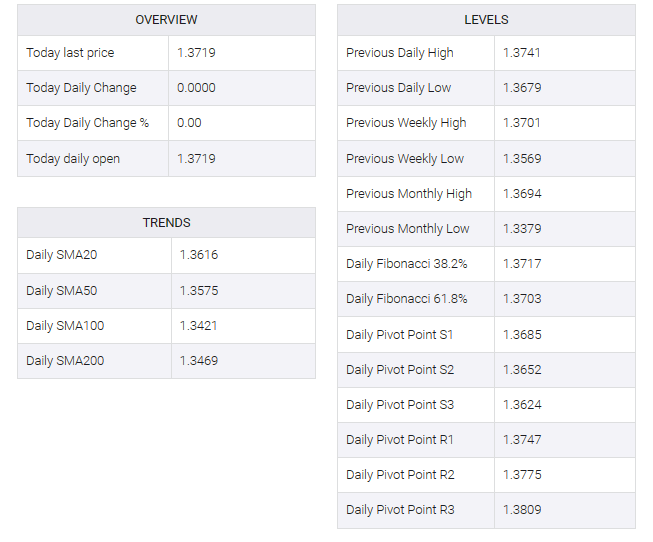

USD/CAD continues the winning streak for the fourth consecutive day, trading lower around 1.3720 during the European session on Friday. The pair receives upward support as the risk-off sentiment prevails, which could be attributed to the fears of an escalation in the Middle East conflict, particularly due to the preparations for a potential ground invasion of Gaza by Israel.

Recent statements by Federal Reserve Chairman Jerome Powell have put some pressure on the USD/CAD pair. Powell indicated that the central bank has no plans to raise rates in the short term, giving the pair a respite. However, Powell also emphasized that future policy adjustments will depend on economic indicators, particularly growth and labor market conditions.

US President Joe Biden’s scheduled speech on Thursday underscores the global significance of the Middle East situation, raising concerns about the potential wider impact on currency markets.

The US dollar index (DXY) rebounded from weekly lows, reaching around 106.40. Higher US Treasury yields and strong economic data, including initial jobless claims falling to the lowest since January, contributed to the dollar’s strength. However, challenges in the housing market, reflected in a 2.0% MoM decline in existing home sales, highlight some economic headwinds.

The release of weak Canadian consumer inflation data on Tuesday prompted investors to scale back their expectations for another rate hike by the Bank of Canada (BOC). This, in turn, is seen as a significant factor contributing to the relative underperformance of the Canadian dollar (CAD), providing support for the USD/CAD pair.

However, the bullish trend in crude oil prices, which supports the commodity-linked loonie, could act as a counterforce, limiting further gains in the USD/CAD pair.

West Texas Intermediate (WTI) oil prices extended gains for a fourth straight day, trading around $89.00 a barrel higher during the European session on Friday.

The recent rise in oil prices is closely linked to concerns over a possible escalation of the Israel-Gaza conflict across the Middle East. There are fears that such an increase could disrupt oil supplies from one of the world’s major producing regions.

Furthermore, the US government’s decision to purchase 6 million barrels of crude oil for delivery to the Strategic Petroleum Reserve (SPR) in December and January adds another dimension to the market dynamics. This move is part of a broader initiative to replenish the emergency stockpile, reflecting efforts to enhance the country’s energy security.