-

USD/CAD prints mild gains to reverse the previous day’s losses, grinds higher around the key upside hurdle.

-

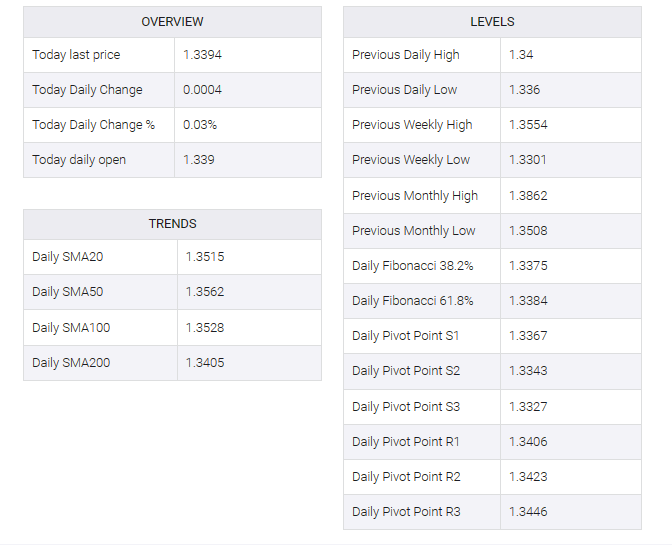

200-DMA, three-week-old descending trend line and 23.6% Fibonacci retracement together highlight 1.3400 as the key resistance.

-

Upward sloping trend line from early February restricts immediate downside amid nearly oversold RSI (14).

USD/CAD bulls jostle with the key upside hurdle around 1.3400 as they reverse the previous day’s pullback moves during a sluggish Wednesday morning in Europe. In doing so, the Loonie pair stays on the way to posting the weekly gains after falling heavily in the last week.

That said, a convergence of the 200-DMA, the down-sloping trend since March 24 and the 23.6% Fibonacci retracement level of the USD/CAD pair’s decline from October-November 2022 together highlight 1.3400 as a key upside barrier.

Also challenging for the bulls is the bearish condition of the RSI (14), even if the prod is close to the oversold zone of the line.

If the quote manages to successfully cross the 1.3400 barrier, a new monthly high, currently around 1.3555, cannot be ruled out.

However, the 50% and 61.8% Fibonacci retracement levels, near 1.3600 and 1.3695 respectively, will be next to tempt USD/CAD buyers ahead of the March high of 1.3865.

Alternatively, pullback moves remain elusive unless the Loonie pair stays beyond an ascending support line from early February, close to 1.3330 by the press time.

Following that, a slump to the yearly low marked in February around 1.3260 can’t be ruled out.

USD/CAD: Daily chart

Trend: Further upside expected