-

USD/CAD remains supported above 1.3550 ahead of US ADP labor demand data.

-

If Employment Change data replicates Job Openings performance, selling pressure on the USD Index would elevate.

-

The Lonnie asset turns sideways after a sell-off move to near the 200-period EMA.

The USD/CAD pair retreats after a short-lived pullback move to near 1.3577 in the European session. The Loonie asset remained broadly sideways on Wednesday as investors sidelined ahead of the United States Employment Change data for August to be reported by Automatic Data Processing (ADP).

As expected, the US private sector recorded new additions of 195K, which was significantly lower than July’s reading of 324K. The job vacancies data released on Tuesday was lower and eventually put significant pressure on the US Dollar Index (DXY). If employment change data replicates the performance of job openings, selling pressure on the USD index could increase and it could slip into a bearish trajectory.

This week, the Canadian dollar will dance to the tune of Q2 gross domestic product (GDP) data. Investors are speculating that growth in the April-June quarter was slower than the pace of growth in Q1 due to the risk of a higher interest rate hike by the Bank of Canada (BoC).

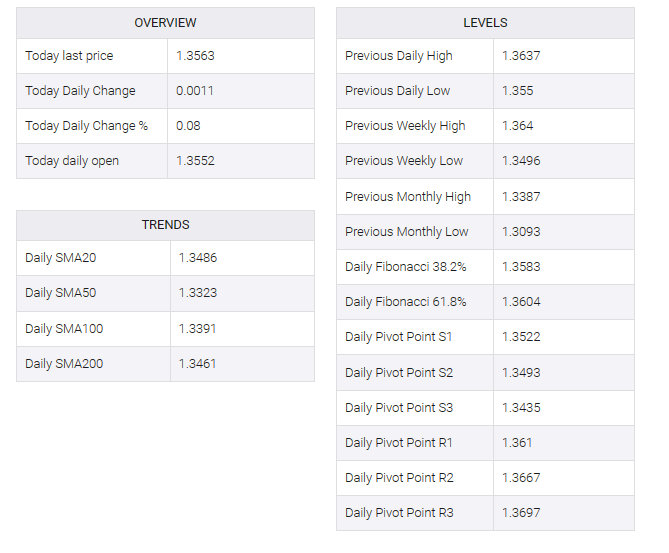

USD/CAD discovered selling pressure after forming a double top on the hourly scale, indicating that bids from investors were not enough when attempting a breakout above 1.3640 on August 25. Loony assets turned back to the 200-period exponential moving average (EMA), after a sell-off move near 1.3560.

A break in the bearish range of 20.00-40.00 by the Relative Strength Index (RSI) (14) would trigger a downside impulse.

Going forward, a downside move to the August 29 low of 1.3550 would expose the asset to the August 24 low of 1.3510, followed by the August 9 high of 1.3454.

In an alternate scenario, a solid recovery above August 25 high at 1.3640 will drive the asset toward March 28 high around 1.3700 and March 27 high at 1.3745.