-

A risk-off mood in global markets has strengthened the US dollar,

-

A bull cross, represented by the 20-and 50-EMAs at 1.3578, indicates more upside ahead.

-

The RSI (14) has jumped into the bullish range of 60.00-80.00, which supports the greenback.

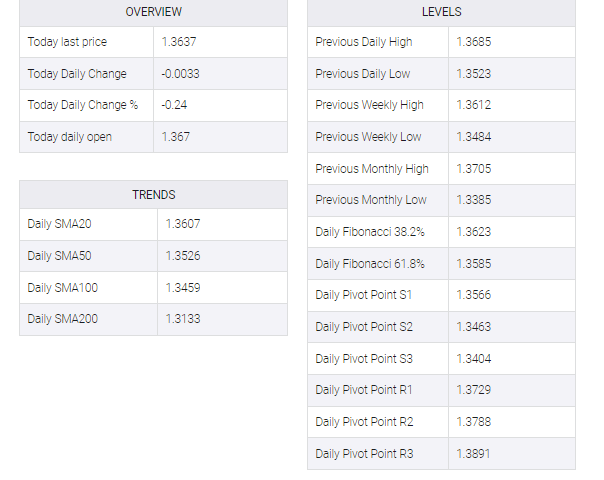

The USD/CAD pair has dropped to near 1.3636 in the Asian session after multiple failed attempts of breaking above the critical resistance of 1.3680. The US Dollar Index is delivering a subdued performance as investors are restricting themselves from making potential positions before the release of the United States ISM Manufacturing PMI data.

Meanwhile, S&P500 futures are trying to recover after a two-day sell-off, however, recovery elasticity is still absent, indicating that the risk profile is still negative.

Investors should note that the trend has turned bullish on the four-hour scale after being topsy-turvy for a long time. Loonie assets may face barricades around horizontal resistance plotted near the round-level hurdle of 1.3700.

A bull cross, represented by the 20- and 50-period exponential moving averages (EMAs) at 1.3578, points further to the upside.

Meanwhile, the Relative Strength Index (RSI) (14) has jumped into the bullish range of 60.00-80.00, which indicates more upside ahead.

A decisive break above the December 16 high around 1.3700 will strengthen the US Dollar and will drive the Loonie asset toward October 25 high at 1.3748 and November 3 high at 1.3808.

On the contrary, the major could drop to November 23 high at 1.3440 after surrendering the psychological support of 1.3500. Later on, a slippage below 1.3440 will expose the Loonie asset for more downside towards December 5 low at 1.3385.