-

USD/CAD extends pullback from seven-week high during two-day losing streak.

-

Bearish candlestick formation, U-turn from key resistance line in favor of sellers.

-

100-DMA, resistance-turned-support line challenges Loonie pair sellers amid bullish MACD signals.

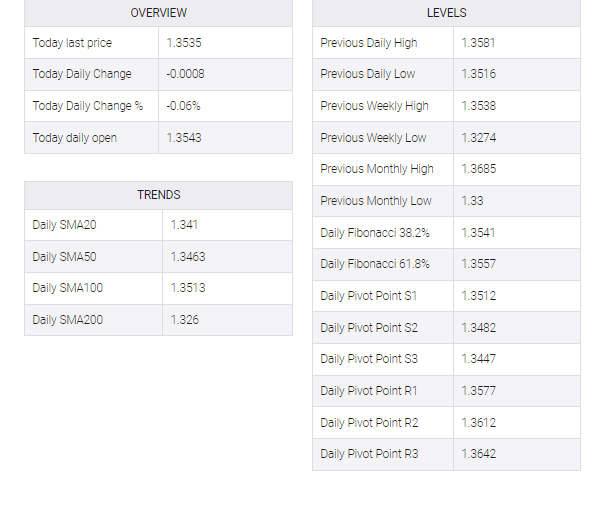

USD/CAD holds lower ground near 1.3530 as bears cheer the previous day’s U-turn from the key resistance line during early Friday. Adding strength to the downside bias is Thursday’s bearish spinning top candlestick.

However, bullish MACD signals and nearness to the 100-DMA support, around 1.3510 by the press time, hints at limited downside room for the Loonie pair.

Even if the quote breaks the stated DMA support, the previous resistance line from early November, around 1.3490 at the latest, could challenge the downside moves.

It should be noted that the early February highs near 1.3475 and multiple levels surrounding 1.3400 also put a floor under the USD/CAD prices.

It’s worth observing that an upward-sloping support line from November 15, close to 1.3280 as we write, becomes crucial for the pair bears to watch during the quote’s weakness past 1.3400.

Alternatively, recovery moves need to cross the aforementioned resistance line from early November, near 1.3580, to convince USD/CAD buyers.

Following that, the early January high near 1.3685 and December 2022 peak surrounding 1.3705 will gain the market’s attention.

Overall, USD/CAD remains on the bull’s radar but the short-term pullback can’t be ruled out.

USD/CAD: Daily chart

Trend: Limited downside expected