-

USD/CAD remains pressured after retreating from six-week high.

-

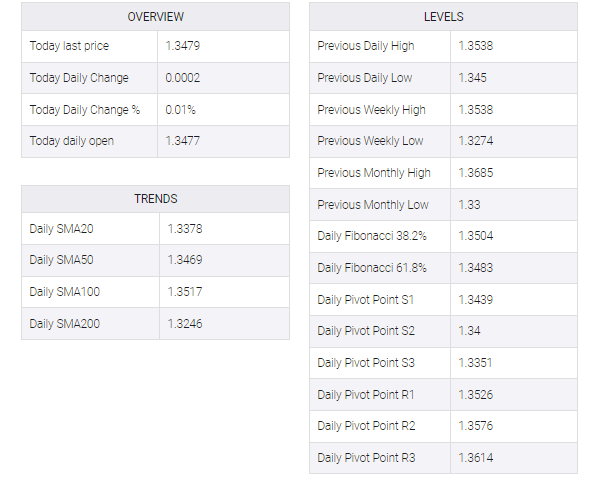

Upbeat oscillators, sustained trading beyond 50-DMA keep buyers hopeful.

-

Convergence of the 100-DMA, the four-month-old descending resistance line challenges buyers.

USD/CAD bulls take a breather around 1.3480, following the run-up to refresh the monthly high, as the upside momentum failed to cross the key resistance confluence the previous day.

Even so, the Loonie pair remains on the buyer’s radar on early Monday as it defends the previous week’s upside break of the 50-DMA, close to 1.3465 at the latest.

It’s worth mentioning that the 50-DMA breakout joins the bullish MACD signals, as well as the upbeat RSI (14), not overbought, to keep the USD/CAD buyers hopeful.

That said, the one-week-old ascending support line near 1.3440 at press time adds a short-term downside filter for the USD/CAD pair traders looking at a break of the 50-DMA.

Following that, a three-month-old ascending support line, around 1.3280 as we write, becomes crucial to follow as it holds the key to the Loonie pair’s slump towards the 1.3000 psychological magnet.

Meanwhile, an upside clearance of the 1.3520 resistance confluence enables the USD/CAD buyers to aim for the previous monthly high of 1.3685.

In case where the quote remains firmer past 1.3685, the last December’s peak of 1.3705 may act as an extra check for the USD/CAD bulls before directing them to the October 2022 high surrounding 1.3980, as well as the 1.4000 round figure.

To sum up, USD/CAD remains on the bull’s radar unless breaking 1.3440 support.

USD/CAD: Daily chart

Trend: Further upside expected